July 05, 2018

EU28 current account surplus €63.9 bn and €47.5 bn surplus for trade in services

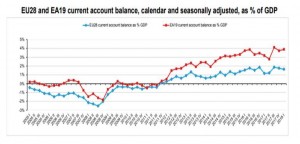

According to the latest report published by Eurostat, the statistical office of the European Union, “The EU28 seasonally adjusted current account of the balance of payments recorded a surplus of €63.9 billion (1.6% of GDP) in the first quarter of 2018, down from a surplus of €68.0 billion (1.8% of GDP) in the fourth quarter of 2017 and up from a surplus of €43.9 billion (1.2% of GDP) in the first quarter of 2017.”

However, in comparison to the fourth quarter of 2017, in the first quarter of 2018 both the surplus of the goods account (+€34.7 bn compared to +€41.1 bn) and the surplus of the services account (+€47.5 bn compared to +€49.9 bn) had decreased.

The report went on to state that the primary income account changed from a deficit into a surplus (+€2.3 bn compared to -€1.6 bn). On the other hand, the deficit of the secondary income account decreased (-€20.6 bn compared to -€21.5 bn), as did the deficit of the capital account (-€1.9 bn compared to -€4.2 bn).

Current account of Member States (including intra-EU flows)

Based on available non-seasonally adjusted data, in the EU28 Member States, the total (intra-EU plus extra-EU) current account balances recorded fourteen surpluses, eleven deficits, one in balance and two data which were confidential in the first quarter of 2018.

Notably, the highest surpluses were observed in Germany (+€71.5 bn), Austria (+€5.3 bn), Italy (+€4.8 bn), Czech Republic (+€2.3 bn) and Sweden (+€2.2), and the largest deficits in the United Kingdom (-€23.1 bn), France (-€13.0 bn) and Greece (-€2.8 bn).

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein