May 13, 2022

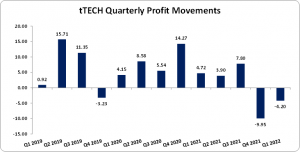

tTech Limited (tTech), for the three months ended March 31, 2022, booked a 2% increase in Revenues to $97.99 million compared to $96.37 million recorded in Q1 of 2021. Cost of sales also increased by some 19% to $37.46 million, up from $31.39 million in 2021. As such, gross profit for the first quarter of FY22 decreased by 7% to $60.53 million (2021: $64.98 million).

tTech’s administrative expenses rose 5% year over year to $58.18 million (2021: $55.30 million) and ‘Other operating expenses’ rose by some 56% to $7.47 million vs $4.79 million recorded in Q1 of 2021. Owing to the proportionately larger increase of expenses to revenue, tTech reported an Operating Loss of $5.11 million relative to the operating profit of $4.90 million booked the prior year. In their quarterly report, tTech’s CEO gave the following insight: “The increase in expenses, the inability to close some projects primarily due to the continuous global supply chain issues, and contract terminations towards the end of 2021 contributed to tTech experiencing a challenging first quarter.”

After earning Finance Income of $605,000 (2021: $484,000), and repaying ‘Finance costs’ of $552,000 (2021: $582,000) tTech reported Loss before taxation of $5.05 million, relative to Profit before taxation of $4.80 million booked the year before.

After Tax credit $854,000 (2021: Tax charge $83,000), tTech posted a Net Loss of $4.20 million relative to Net Profit of $4.72 million reported in Q1 2021. Additonally, tTech only received $10,000 of ‘Other Income’ in Q1 of 2022, (2021: $17,000).

The company reported Loss per share (LPS) of $0.04 for the quarter, relative to the Earnings Per Share of $0.04 in the same period a year later. On a twelve-month trailing basis, tTech also experienced a LPS amounting to $0.01. The number of shares used in our calculations is 106,000,000 units. The company’s stock price closed the trading period on May 12, 2022 at $3.69.

Management noted that. “During the period under review, we successfully presented our new Advanced Security Services to prospects and customers, who showed great interest in demonstrations and proof of concepts. In recent years, the sophistication of cybersecurity threats has increased tremendously, and many businesses are no longer protected by the entry level solutions that they currently have in place. We have been testing Artificial Intelligence based Endpoint Protection Solutions and we are now offering these solutions to customers.” Further adding, “tTech has been participating in several sensitization sessions on data privacy & data protection including celebrating Data Protection Day in January where we introduced Jamaica to the newly appointed Information Commissioner Celia Barclay. There is increased interest in services related to Data Privacy & Protection as the deadline date for compliance is now written law.”

Balance Sheet Highlights:

As at March 31, 2022, the Company’s total assets declined by 7%, to end at $315.18 million (2021: $340.15). Total Liabilities however decreased by 15% from $92.26 million to $78.20 million largely due to reductions in current liabilities, namely ‘Bank Overdraft’ which amounted to $47.43 million (2021: 55.49 million) & ‘Accounts Payable’ which totalled $3.29 million (2021: $6.02 million)

Shareholders’ Equity as at March 31, 2022 was $236.98 million compared to $247.27 million for the comparable period of 2021. This resulted in a book value per share of $2.24 compared to $2.33 in Q1 of 2021.

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may affect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.