Total revenue grew by 3% amounting to $4.09 billion, up from $3.98 billion reported a year ago. According to the company, “this was netted with the drawdown of clinker and cement valuing $480 million when compared to the same quarter in 2016. Repairs and maintenance was $36 million as a result of routine maintenance of cement mill #5 and the existing coal mill.”

Earnings before interest, tax, depreciation & amortization (EBITDA) amounted to $684.34 million, a decline of 36% relative to $1.07 billion for the prior year’s corresponding period. CCC noted this, “resulted from the same impact of the stock draw down.”

Depreciation and amortization closed at $134.17 million (2016: $98.82 million). As a result, operating profit totaled approximately $550.17 million (2016: $966.24 million) for the period, a decline of 43% year over year.

Interest Income amounted to $1.84 million for the period compared to $1,000 for the corresponding period in 2016. Finance Costs for the three months rose 67% to close at $24.16 million compared to $14.50 million for the corresponding period of 2016.

Profit before taxation amounted to $527.85 million, this compares with profit of $951.74 million recorded last year. Taxation for the period declined 43% from $117.83 million to $67.49 million.

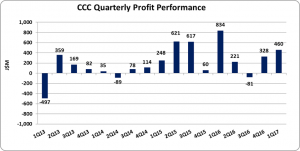

Net profit for the first quarter closed at $460.36 million relative to net profit of $833.91 billion booked for the corresponding quarter in 2016, a decrease of 45%.

Consequently, earnings per share (EPS) amounted to $0.54 (2016: $0.98), while twelve months trailing EPS is $1.09. The number of shares used in this calculation was 851,136,591 shares.

CCC highlighted, “the Board of Directors remains committed to meeting the local cement demand; reinforcing the profitability and competitiveness of plant and to the continuous improvement and promotion of health and safety standards while creating a better work environment for our people.”

Balance sheet at a Glance:

Total Assets fell by $645.43 million or 6% to close at $11.07 billion as at March 31, 2017 (2016: $11.72 billion). The decrease in total assets was largely due to the $1.21 billion decrease in inventories closed at $1.86 billion (2016: $3.06 billion). Receivables and prepayments also contributed to the decline with a 51% decrease year over year to $835.43 million (2016: $1.71 billion).

Shareholder’s equity totaled $8.20 billion compared to the $7.27 billion quoted as at March 30, 2016. This resulted in a book value of $8.71 (2015: $8.54). The number of shares used in our calculations amounted to 851,136,591 units.