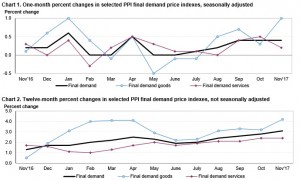

The Producer Price Index increased 0.4% in November 2017 according to the U.S. Bureau of Labor Statistics. This follows a 0.4% upward movement in both October and September. On an unadjusted basis, the final demand index rose 3.1% for the 12 months ended in November. The final demand index in November rose due to a 1% growth in prices for final demand goods, while the index for final demand services increased 0.2%.

Final Demand

Final demand goods: The index for final demand goods edged up 1%, the largest increase since a 1% growth in January. According to the Bureau of Labor Statistics, “Over three-fourths of the broad-based November rise can be traced to prices for final demand energy, which climbed 4.6%. The indexes for final demand goods less foods and energy and for final demand foods both advanced 0.3%.” the increase in the index for final demand goods was traced to gasoline prices which reflected a 15.8% increase. The indexes for light motor trucks, pharmaceutical preparations, beef and veal, residential electric power, and jet fuel also moved higher. In contrast, prices for processed young chickens fell 5.7%. The indexes for ethanol and commercial electric power also declined.

Final demand services: An advance of 0.2% was observed in November 2017. The growth in the index less trade transportation, and warehousing moved up 0.4%. Prices for final demand transportation and warehousing services climbed 0.6 percent. Conversely, margins for final demand trade services decreased 0.3 percent. The movement in November according to According to the Bureau of Labor Statistics was due to, “prices for loan services (partial), which increased 3.1 percent. The indexes for traveler accommodation services; health, beauty, and optical goods retailing; food and alcohol retailing; chemicals and allied products wholesaling; and apparel, footwear, and accessories retailing also moved higher. In contrast, margins for machinery and equipment wholesaling declined 1.9 percent. The indexes for fuels and lubricants retailing and for bundled wired telecommunication access services also fell.”

The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.