Date: January 15, 2018

For the three months ended November 30, 2017:

AMG Packaging and Paper Company Limited recorded Turnover in the amount of $193.14 million, a growth of 24% when compared to $155.38 million the previous year.Cost of Inventories totaled $115.40 million, an increase of 48% relative to the corresponding period in the prior financial year of $77.75 million. Direct Expense climbed year over year by 12% to $35.05 million (2016: $31.34 million). Total Manufacturing Costs for first quarter amounted to $150.45 million, 38% higher than the $109.09 million reported for the first quarter of 2016. As such Gross Profit amounted to $42.69 million (2016: $46.29 million).

The company reported that “The demand for paper rolls on the world market has significantly increased riven up the cost of paper rolls. Presently, paper cost is approximately 30% higher than at the same period last year. This has reflected negatively as seen in the financials.”

Administrative Expenses grew by 14% to close at $19.91 million (2016:$17.47 million), while Depreciation climbed 30% to $7.3 million (2016: $5.62 million). Finance Expense for the period declined to $2.43 million, 18% lower than the $2.96 million booked for the first quarter of 2016. Directors Fees for the period amounted to $2.60 million (2016: $1.30 million).

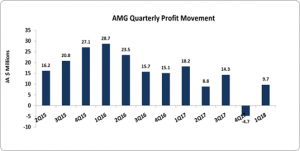

As such, Pre-tax Profit closed at $10.44 million, 45% less than the $18.94 million reported for the first three months ended November 30, 2016. Following tax charges of $1.54 million (2016: $2.54 million), Net Profit Attributable to Shareholders amounted to $9.73 million, a decline of 46% relative to net profit of $18.17 million in 2016.

Earnings per share for the period amounted to $0.02 (2016: $0.4). The twelve month trailing EPS amounted to $0.06. The number of shares used in our calculations amounted to 511,894,285 units. Notably, AMG’s stock price closed the trading period on January 12, 2018 at a price of $2.62.

The company outlined that “the closing down of the Toilet Paper factory got underway during this quarter and the associated costs continue to impact profitability.”

Balance Sheet Highlights:

As at November 30, 2017, Total Assets amounted to $708.15 million, 6% more than the $667.24 million a year ago. The main contributor to the increase in AMG’s total asset base was cash and bank balances which totaled $44.24 million (2016: $28.68 million). Property, Plant & Equipment amounted to $381.82 million, 25% above the $306.08 million posted a year ago.

Shareholder’s Equity as at November 30, 2017 totaled $494.40 million (2016: $439.34 million) resulting in a book value per share of approximately $0.97 (2016: $0.86).

The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.