Date: June 28, 2018

Brent Oil

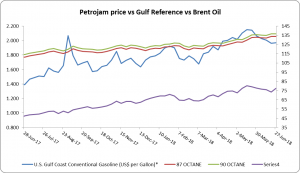

Brent oil prices increased by 5.41% or US$3.97, as prices rose this week. Oil traded on June 28, 2018 at a price of $77.41 per barrel relative to US$73.44 last week. Brent oil began the year at US$68.07 per barrel.

Petrojam prices

87 Octane prices decreased week over week, by 0.15% (JMD$0.20). Additionally 90 Octane also decreased by 0.15% or (JMD$0.20) week over week. 87 Octane and 90 Octane opened the year at J$121.04 and J$123.88 respectively and now trades at J$133.58 and J$136.42 per litre respectively.

Figure 1: Petrojam, U.S. Gulf Coast Conventional Gasoline Regular and Brent Crude Oil 1 Year Price History

This Week in Petroleum

For the period 2017 to 2018, U.S. refinery capacity remained relatively unchanged

According to the U.S. Energy Information Administration’s (EIA) recently released Refinery Capacity Report “As of January 1, 2018, U.S. operable atmospheric crude distillation capacity totaled 18.6 million barrels per calendar day (b/cd), a slight decrease of 0.1% since beginning of 2017.”

“Annual operable crude oil distillation unit (CDU) capacity had increased each of the five years before 2018 and has remained greater than 18 million b/cd since January 1, 2016. The capacities of secondary units that support heavy crude oil processing and production of ultra-low sulfur diesel and gasoline, including thermal cracking (coking), catalytic hydrocracking, and hydrotreating/desulfurization, increased slightly from year-ago levels. These downstream capacity increases are primarily the result of debottlenecking–when refineries increase the throughput of existing infrastructure–rather than large new builds.”

“Methodological reclassifications drove a reduction in the number of operating refineries in EIA’s latest report as of the beginning of the year. According to the Refinery Capacity Report, the total number of operable refineries recorded in the report decreased from 141 on January 1, 2017, to 135 on January 1, 2018. These changes to the survey data include merging four refineries previously considered separate in survey data into two and the re-categorization of two refineries from idle to shut down. Consequently, the decrease in number of operating refineries does not necessarily represent a meaningful shift in U.S. refinery operating capacity.”

For additional information click the link below:

Disclaimer:

Analyst Certification -This research report is for information purposes only and should not be construed as a recommendation. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.