July 06, 2018

Goods and Services Trade Deficit

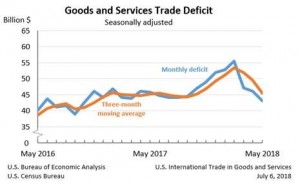

The U.S. Bureau of Economic Analysis indicated that, “The goods and services deficit was $43.1 billion in May, down $3.0 billion from $46.1 billion in April.” May exports ($215.3 billion) exceeded exports in April by $4.1 billion, whereas $258.4 billion was recorded for imports in May which was $1.1 billion more than April imports.

The report mentioned that year-to date from the same period in 2017, there was a 7.9 percent increase in the goods and services deficit. As for exports and imports they both increased by 8.8 percent and 8.6 percent respectively.

Three-Month Moving Averages

Based on available seasonally adjusted data, for the three months ending in May, the average exports increased $3.1 billion to $212.4 billion while average imports decreased $1.1 billion to $257.9 billion.

In relation to export of goods, these consists of capital goods, foods, feeds and beverages and other goods which all increased by $2.0 billion, $1.7 billion and $0.9 billion respectively, while industrial supplies and materials decreased by $1.3 billion. Additionally, export of services such as transport, other business services and financial services all increased by $0.1 billion.

As for imports of goods, capital goods increased by $2.1 billion while consumer goods ($0.5 billion) and other goods ($0.4 billion) decreased. Imports of services included transport and travel which both decreased by $0.1 billion and as for other business services, this increased by $0.1 billion.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.