March 18, 2020

For the year ended December 31, 2019, Fosrich Company Limited (FOSRICH)’s revenue rose by 25% to $1.61 billion relative to 2018’s $1.29 billion. Revenue for the quarter amounted to $425.73 million, 23% above the $347.33 million booked for the similar quarter of 2018.

Cost of sales increased by 19% to $902.22 million (2018: 759.23 million). As a result, gross profit increased by 33% to $709.95 million compared to $534 million in 2018. Gross profit for the quarter amounted to $195.12 million (2018: $123.64 million). The company reported that, “These increases were attributed primarily to the greater availability of the products required by the market. Other income for the year benefitted from favourable foreign exchange gains amounting to $18 million and interest income totalling $13 million.”

Other income totalled $51.98 million for the period relative to the previous year’s gain of $47.41 million.

Total expenses increased by 35% to $660.27 million (2018: $490.29 million). Of this, administrative and other expenses increased to $560.57 million (2018: $422.79 million). FOSRICH reported that this was due to, “there were increases in staff related costs associated with our commencement of PVC manufacturing, local travel associated with increased activity, legal and professional fees and rent. Decreases were driven primarily by efficiencies gained from reduced staff training, computer expenses, foreign travel, bank charges and reductions in damaged goods write-off and warranty expenses.” While finance costs expenses recorded an increase of 48%, closing at $99.69 million (2018: $67.50 million). The movement according to FOSRICH was, “driven by increased financing obtained to assist with the financing of operations. This new financing was obtained at more favourable rates than the previous bank facilities.” Total expenses for the quarter amounted to $199.01 million compared to $133.57 million for the previous period.

Consequently, profit before taxation amounted to $101.66 million relative to $91.11 million in 2019, representing a 12% increase year-on-year.

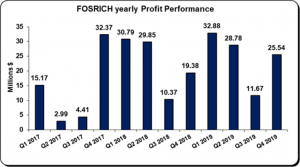

Tax charges for the year were $2.79 million a 289% increase when compared with $718,259. As a result, net profit for the year amounted to $98.87 million relative to $90.39 million. Net profit for the quarter amounted to $25.54 million (2018: $19.38 million).

Total comprehensive income for the year amounted to $98.22 compared to $88.43 million for 2018.

Earnings per share amounted to $0.20 for the period relative to earnings per share of $0.18 in 2018. EPS for the quarter amounted to $0.05 (2018: $0.04). The number of shares used in our calculations is 502,275,555. Notably, FOSRICH stock price close the trading period on March 17, 2019 at $2.74.

Balance Sheet Highlights:

The company, as at December 31, 2019, recorded total assets of $2.24 million, an increase of 9.19% when compared to $2.05 million recorded last year. The increase was mainly attributed to inventories and due from related party which closed at $1.17 billion (2018: $1.02 billion) and $282.61 million (2018: nil). Management noted, “The company continues to closely manage inventory balances and the supply-chain, with a view to ensuring that inventory balances being carried are optimised, relative to the pace of sales, the time between the orders being made and when goods become available for sale, to avoid both overstocking and stock-outs. Monitoring is both at the individual product level and by product categories. All our locations reflected increases in inventory values across all inventory categories.”

Total Stockholders’ Equity as at December 31, 2019, closed at $791.58 million (2018: $693.36 million) resulting in a book value per share of $1.58 per share compared to $1.38.

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.