July 30, 2020

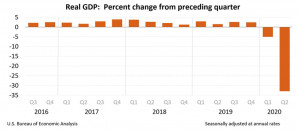

U.S. real gross domestic product (GDP) contracted 32.9% for the second quarter of 2020, subsequent to a 5% decline for the first three months of 2020 as the economy experienced a nose-dive in activity. Current-dollar GDP for the second quarter declined $2.15 trillion or 34.3% to 19.41 trillion, compared to a 3.4% of $186.3 billion fall in the first quarter. According to the Bureau of Economic Analysis (BEA), GDP for the second quarter reflected the response to COVID-19 as “stay-at-home” orders issued in March and April were partially lifted in some areas of the country in May and June. During this period, government pandemic assistance payments were distributed to households and businesses. This action led to swift changes in activity, as businesses and schools continued remote work, and consumers and businesses canceled, restricted, or redirected their spending.

GDP performance for Q2 2020 was impacted by declines in personal consumption expenditures (PCE), exports, private inventory investment, nonresidential fixed investment, residential fixed investment, and state and local government spending. Impacting the performance was sharp contractions in services and goods. Declines in exports echoed a decrease in goods, led by capital goods, while the decrease in private inventory investment primarily reflected a reduction in retail, led by motor vehicle dealers. BEA also indicated, “the decrease in nonresidential fixed investment primarily reflected a decrease in equipment (led by transportation equipment), while the decrease in residential investment primarily reflected a decrease in new single-family housing.”

Current personal income rose 1.39 trillion for the second quarter, relative to an increase of $193.4 billion for the first quarter. The growth was attributed to government transfer payments associated with the coronavirus pandemic. Despite the rise, personal outlays collapsed by $1.57 trillion, due largely to a drop in services spending.

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein