August 14, 2020

Medical Disposables & Supplies Limited (MDS) for the three months ended June 30, 2020, reported revenue of $510.08 million, a decrease of 8% compared to the $557.23 million booked in 2019. According to Management, “this decline in sales is a direct result of the economic downturn brought about by the COVID-19 pandemic and the measures implemented to curtail its spread. With the pharmacy network and patients overstocking multiple months’ supply on prescription items due to uncertain drug availability, the quarter reflected minimal sales activity due to market oversupply. Hospital activity was also minimalized due to social distancing, quarantine preparations, restriction of population movement, resulting in the postponement of elective surgeries and prioritizing of critical cases only. Doctors’ office closures and reduction in operating hours, also reduced patient load, all of which resulted in sales reductions of 9% and 22% in the Pharmaceutical and Medical Divisions, respectively. Year over year saw a decrease of 8.5% or $47.15M in sales of medical supplies.”

Cost of Sales decreased by $18.81 million to total $397.24 million relative to $416.05 million in 2019. As a result, Gross Profit fell by 20% or $28.34 million to total $112.84 million compared to $141.18 million in 2019.

Total Operating Cost rose 12% to close at $114.96 million (2019: $102.64 million), MDS noted that, “the movement was due to the costs associated with boosting the sales effort, particularly in the Consumer Division.” Of this:

Selling and Promotional costs rose 24% to $55.90 million relative to $44.99 million in 2019.

Administrative Expenses went up by 1% to close the three months period at $53.29 million (2019: $52.52 million).

MDS recorded Other Operating income of $606,708 for the first quarter of 2019 relative to nil for the period under review.

Depreciation decreased by 2% to close the quarter at $7.03 million (2019: $7.14 million).

As a result, operating loss closed the first quarter at $2.12 million relative to an operating profit of $38.54 million in 2019. MDS reported gain on Foreign Exchange of $4.04 million versus a loss of $9.40 million twelve months earlier. This according to MDS was due mainly to, “Total non-operational expenses decreasing significantly from $15.9M in 2019 to $4.95M in 2020 or 75.4%, causing a significant contributor to gain on foreign exchange.”

Finance Cost for the three months amounted to $9.20 million relative to the $10.77 million reported in 2019, a 15% decrease year over year.

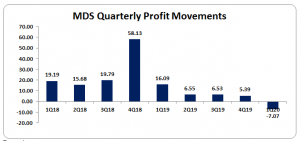

Pre-tax loss totalled $7.07 million, down from a profit of $18.38 million booked for the corresponding quarter of 2019. Net loss for the quarter amounted to $7.07 million after no taxation was recorded (2019: $2.48 million) relative to a net profit of $15.90 million booked for the first three months of 2019.

Loss per share for the first quarter amounted $0.027 (2019: EPS $0.060). The trailing earnings per share amounted to $0.04. The number of shares used in the calculation was 263,157,895. MDS stock price closed the trading period on August 14, 2020 at $4.93.

The company noted, “Despite the significant impact on the business brought about by the containment strategies imposed to combat the spread of COVID-19, we continue to realign our business strategies to focus on deeper market penetration and strengthening relationships with our customers, shareholders and the MDS family.”

Balance Sheet at a glance:

As at June 30, 2020, Total Assets rose by 14% amounting to $1.88 billion (2019: $1.65 billion). This was due to an increase in the company’s ‘Inventories’ which ended the period at $782.84 million (2019: $582.14 million). ‘Property, Plant & Equipment’ also contributed to the growth closing at $607.72 million (2019: $561.19 million).

Shareholders’ equity totalled $826.69 million (2019: $775.30 million), resulting in a book value per share of $3.14 (2019: $2.95).

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.