August 2, 2022

Jamaica Stock Exchange Group (JSE) for the six months ended June 30, 2022 recorded total revenue of $1.13 billion, a 33% increase when compared to the $851.94 million booked the prior comparable quarter, management noted, “The increase can be attributed to improved market conditions and market activities which has resulted in the significant improvement in Cess and Fee Income.” Of this:

o Cess income increase by 102% from $133.58 million booked for the period ended June 2021 to $269.24 million recorded for the period under review.

o Fee income grew by 22% to $786.8 million to close the quarter under review up from $646.49 million reported in the same quarter of 2021.

o E-campus income decreased by 17% to $17.91 million relative to $21.6 million documented in the prior comparable quarter.

o Other operating income rose 17% during the period to total $58.69 million compared to $50.24 million booked in the same quarter last year.

Total expenses for the six months increased by 21% moving from $590.02 million recorded as at June 2021 to $714.30 million in the six months ended June 30, 2022. Of this:

o Staff cost increased 21% to total $326.41 million for the period under review (2021: $269.61 million) and was primarily due to, “a 6% increase in salaries as well as a reclassification exercise resulting in the upward movement in salaries of some positions,” JSE noted.

o Depreciation and amortization totalled $36.77 million, relative to $32.93 million recorded in the prior comparable period.

o Professional fees amounted to $64.71 million (2021: $57.90 million), resulting in a 12% year over year increase.

o Property expenses climbed 14% to $143.41 million (2021: $125.39 million) for the period under review.

o Other operating expenses increased by 28% to $31.58 million (2021: $24.60 million).

o Advertising and promotion went up by 43% from $42.64 million in 2021 to $60.85 million in the period under review.

o Securities commission fees posted a 86% increase to close at $37.77 million (2021: $20.35 million) and as stated by JSE, “reflecting the direct correlation between Cess revenue and fees paid.”

o Net impairment losses on financial assets closed at $4.02 million, relative to a gain of $1.17 million booked in the previous corresponding quarter.

o E-campus expense increased by 9% to $16.82 million (2021: $15.43 million).

Investment income declined from $19.54 million recorded in June 2021 to $47,000 as at June 2022.

Profit before tax totalled $418.4 million compared to $281.46 million reported in the corresponding period last year. For the quarter, profit before tax closed at $212.70 million (2021: $167.12 million).

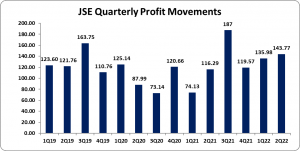

Tax charges for the period totalled $138.66 million (2021: $91.04 million). As such, JSE reported a net profit for the period of $279.75 million compared to a profit of $190.42 million in the prior comparable period, reflecting a 47% increase. Notably, JSE highlighted that, “the increase in Net Profit reflects the improvement in Total Income during the quarter, primarily driven by the higher trading values in the market.” While, for the quarter, net profit amounted to $143.77 million (2021: $116.29 million).

Total comprehensive income amounted to $253.94 million relative to $192.97 million recorded in the previous corresponding period.

Earnings per share for the six months totaled $0.40 (2021: $0.27). EPS, for the quarter, totalled $0.21 (2021: $0.17). The twelve-months trailing EPS is $0.84. The numbers of shares used in the calculations are 701,250,000 units. JSE stock price closed the trading period on July 29, 2022 at $17.85, with a corresponding P/E of 21.34 times.

JSE highlighted, “The Second Quarter results has been good and the outlook for the year is for improved performance, as investors and companies continue to demonstrate confidence in the economy despite the lingering threats and impact of COVID 19 and other market uncertainties. We also believe that despite the geo-political unrest which will undoubtedly have some impact on the economy, overall, we do not expect that this will significantly affect income due to our successful diversification strategies.”

Additionally, “The JSEG will continue in the medium to long term to pursue a strategic path of growth through the exploration and promotion of new and existing markets, new product development and the continuous improvement in systems and service delivery to the s customers and other stakeholders.”

Balance Sheet at a Glance:

As at June 30, 2022, total assets were $2.46 billion, a 19% increase when compared to $2.07 billion a year prior. The increase was due to a 28% increase in ‘Property, Plant and Equipment’ to $890.08 million in 2022 from $697.02 million booked for the prior period. ‘Government Securities purchased under resale agreement’ also contributed to the increase by amounting to $603.47 million (2021: $443.62 million).

Shareholders’ Equity amounted to $1.95 billion (2021: $1.61 billion), resulting in a book value per share of $2.78 (2021: $2.30).

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.