December 1, 2022

Massy Holdings Limited (MASSY), for the year ended September 30, 2022, posted revenue of $12.34 billion, an 11% increase when compared to $11.12 billion reported for the comparable period in 2021. For the quarter revenue amounted to $3.17 billion (2021: $2.97 billion).

Operating profit after finance costs rose by 3% to $1.01 billion (2021: $874.79 million). Operating profit for the quarter rose by 26% to end at $390.07 million (2021: $309.20 million).

Share of profit of associates and joint ventures for the period was $18.84 million relative to $50.30 million for the corresponding period last year.

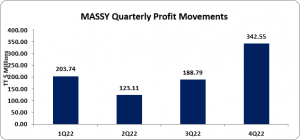

Profit before income tax totalled $1.03 billion (2021: $925.09 million). Income tax expense totaled $305.98 million (2021: $249.84 million). Profit after tax from continued operations totaled $723.34 million, 7% more than the $675.25 million reported a year prior. Profit after tax from discontinued operations for the years was $51.40 million versus $56 million last year. MASSY’s profit for the year amounted $858.19 million (2021: $822.03 million), while profit for the quarter amounted to $342.55 million (2021: $321.72 million).

Profit attributable to owners of the parent as it regards to continuing operations amounted to $679.08 million (2021: $637.07 million).

Profit attributable to owners of the parent as it regards to discontinuing operations amounted to $134.85 million (2021: $151.39 million).

Total Profit attributable to owners of the parent company summed to $813.93 million (2021: $788.46 million), for the quarter profit attributable to owners of the parent company amounted to $329.43 million, 6% more than the $311.24 million reported in 2021.

Total comprehensive income for the period under review amounted to $760.48 million (2021: $789.35 million).

MASSY had an earnings per share (EPS) for the period of $0.411 (2021: EPS $0.398). For the quarter, EPS totalled $0.166 (2021: $0.157). The twelve-month trailing EPS amounted to $0.411. The number of shares used in this calculation was 1,979,384,540 units. As at November 30, 2022, the stock traded at J$81.00 with a corresponding P/E ratio of 8.55 times.

MASSY noted that, “In each of our main Portfolios, we are finding opportunities to acquire private, independently run businesses in most countries we examine. The combination of our ability to further invest in these businesses, with our approach to listening to and empowering existing management, in tandem with our deep understanding of the fundamentals of running these businesses, allows us to grow and improve the operations of these acquisitions and produce attractive returns on our investments.”

Balance Sheet Highlights:

The Company, as at September 30, 2022, held total assets worth $12.70 billion, a 6% decline when compared to $13.53 billion recorded last year. The movement was primarily attributable to a 102% increase in ‘Financial Assets’ to $1.86 billion from $923.52 million in 2021.

Total Shareholders’ equity as at September 30, 2022 closed at $7.25 billion, compared to $6.83 billion recorded for the same period in 2021. This resulted in a book value per share of $3.66 compared to a value of $3.45 reported in 2021.

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.