November 15, 2023

Expressed in United States dollars except otherwise stated:

First Rock Real Estate Investments Limited (FIRSTROCKJMD) for the nine months ended September 30, 2023, reported a 36% decrease in Property Income totaling US$4.00 million compared to US$6.26 million in the corresponding period last year. Property Income for the third quarter had a 48% increase to close at US$1.08 million compared to US$731,377 for the comparable quarter of 2022.

Rental income amounted to US$241,590 (2022: US$506,578), this represents a decrease of 52% year over year. Consequently, realised and unrealised gain on investment properties decreased by 35% to US$3.76 million compared to US$5.75 million for the nine months ended September 30, 2022. The company booked realised and unrealised gain/ on investment properties of US$1.01 million for the third quarter versus US$565,705 reported for the similar quarter of 2022.

Dividend income from financial assets at fair value through profit or loss amounted to US$275,587 (2022: US$65,962). Realised and Unrealised Gain/(Loss) on financial instruments for the period closed at US$733 versus US$3.08 million booked for 2022.

Interest Income from financial assets at amortised cost decreased by 12% to close at US$341,307 (2022: US$386,091), while Interest expense increased by 38% from US$418,781 in 2022 to US$578,987 in the period under review. As a result, net operating income for the nine months ended September 30, 2023, amounted to US$3.87 million, a 59% decrease relative to US$9.45 million reported in 2022.

Total Expenses for the nine months ended September 30, 2023, amounted to US$2.90 million, a 33% decrease relative to US$4.36 million reported in 2022. Total Expenses for the third quarter amounted to US$792,127 (2022: US$669,350). The performance based fee for the period dropped to US$194,695 relative to US$1.52 million reported in 2022. Administrative and general expenses recorded experienced an increase, closing at US$2.66 million (2022: US$2.54 million). As such, operating profit totalled US$961,407, an 81% decrease from the corresponding period last year. (2022: US$5.09 million).

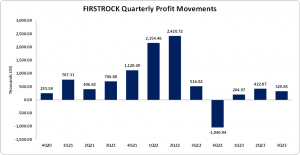

Net Profit after Taxation for the nine months ended September 30, 2023, had an 81% decrease to reach US$957,695 (2022: US$5.09 million). Profit attributable to owners of the company for the nine months amounted to US$957,695, an 81% decrease from the US$5.09 million reported in 2022. For the third quarter, profit attributable to owners of the company was US$329,851 (2022: US$516,018).

The Company noted, “The results were driven primarily by gains in the Group’s real sector and financial assets and property income, which have been achieved through the prudent management of the balance sheet.”

Additionally, “The Group began to realise some gains from its investment in the Torres Los Yoses residential development in Costa Rica. With the successful exit from this investment projected to conclude in Q4, the Group anticipates that some capital will be redeployed into another opportunity in that jurisdiction, which is far advanced in negotiations.”

Consequently, Earnings Per Share for the nine months amounted to US$0.003 (2022: EPS: US$0.014), while Earnings Per Share for the quarter totaled US$0.001 (2022: EPS: US$0.002). The twelve-month trailing LPS was US$0.0003, and the number of shares used in these calculations was 286,025,318.

Notably, FIRSTROCKJMD’s stock price closed the trading period on November 15, 2023, at a price of JM$8.53, while FIRSTROCKUSD closed at US$0.0424.

Balance Sheet Highlights

The Company’s assets totalled US$62.89 million (2022: US$60.72 million). The increase in assets stemmed from a 19% increase in ‘Current development in progress’, closing at US$19.58 million.

Shareholder’s equity was US$36.86 million (2022: US$37.44 million), representing a book value per share of US$0.13 (2022: US$0.13).

Disclaimer:

Analyst Certification – The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure – The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may affect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.