August 28, 2024

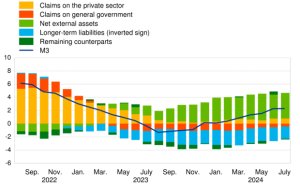

Components of the broad monetary aggregate M3

The annual growth rate of the broad monetary aggregate M3 was 2.3% in July 2024, steady from the previous month and averaging 2.0% in the three months preceding July. The annual growth rate of the narrower aggregate M1, which includes currency in circulation and overnight deposits, was -3.1% in July, compared to -3.4% in June. The annual growth rate of short-term deposits other than overnight deposits (M2-M1) fell to 11.4% in July, from 12.8% in June. The annual growth rate of marketable instruments (M3-M2) rose to 21.0% in July from 18.7% in June.

Counterparts of the broad monetary aggregate M3

The yearly growth rate of M3 in July 2024, as a result of changes in the items on the consolidated balance sheet of monetary financial institutions (MFIs) other than M3 (counterparts of M3), can be broken down as follows: Net external assets contributed 3.9 percentage points (up from 3.6 percentage points in June), claims on the private sector contributed 0.8 percentage points (as in the previous month), claims on general government contributed -0.4 percentage points (up from -0.6 percentage points), longer-term liabilities contributed -1.9 percentage points (up from -2.0 percentage points), and the remaining counterparts of M3 contributed -0.1 percentage points (down from 0.4 percentage points).

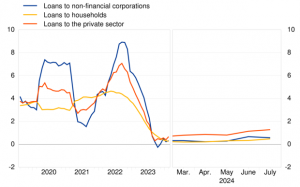

Claims on euro area residents

In July 2024, the annual growth rate for total claims on euro area citizens was 0.3%, up from 0.2% the previous month. The annual growth rate of claims on the general government was -1.1% in July, down from -1.4% in June, while the annual growth rate of claims on the private sector was 0.8% in July, unchanged from the previous month.

The annual growth rate of adjusted loans to the private sector (adjusted for loan transfers and notional cash pooling) rose to 1.3% in July from 1.1% in June. Among the borrowing sectors, the annual growth rate of adjusted loans to households increased to 0.5% in July from 0.3% in June, while adjusted loans to non-financial firms grew at 0.6% in July from 0.7% in June.

(Source: European Central Bank)

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer(s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view(s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.