May 7, 2025

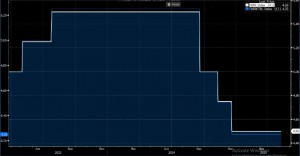

The Federal Open Market Committee (FOMC) decided to maintain the target range for the federal funds rate at 4.25% to 4.50%. This decision reflects the Committee’s assessment that the current economic conditions warrant a steady approach to monetary policy. Economic activity has continued to expand at a solid pace, with the unemployment rate stabilizing at a low level. However, inflation remains somewhat elevated, which is a concern for the Committee as it strives to achieve its dual mandate of maximum employment and stable prices.

The FOMC remains focused on achieving maximum employment and a 2% inflation rate over the longer run. Despite recent improvements in the economy, the risks of higher unemployment and inflation have increased. To address these risks, the Committee will continue to reduce its holdings of Treasury securities and agency debt. This reduction is part of a broader strategy to ensure that monetary policy remains flexible and responsive to changing economic conditions.

During the press conference, Chair Jerome Powell emphasized that the economy is in a solid position, with the labour market near maximum employment. He noted that while inflation has eased, it remains above the 2% target. Powell highlighted that the current policy stance is well-positioned to respond to potential economic developments, ensuring that the FOMC can adjust its approach as necessary to support the economy’s ongoing recovery and stability.

Federal Funds Target Rate

Disclaimer:

Analyst Certification – The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure – The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may affect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.