March 28, 2025

The Bank of Jamaica’s (BOJ) Monetary Policy Committee (MPC) met on March 25 and 26, 2025, to discuss the country’s monetary policy amidst growing uncertainties in the economic policies of Jamaica’s key trading partners. Here are the key points from their discussions and decisions:

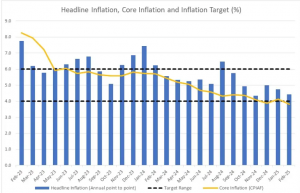

Inflation Trends: The MPC noted that inflation has stabilized within the BOJ’s target range. As of February 2025, annual headline inflation was 4.4%, down from 6.2% in February 2024. Core inflation, which excludes agricultural food products and fuel, was 3.8%, marking the twentieth consecutive month below 6.0%. This reduction in headline inflation was attributed to stability in key inflation drivers, including the exchange rate, which remained stable due to a surplus on Jamaica’s external accounts and BOJ’s monetary policy actions.

Inflation Expectations: Since 2024, private sector expectations of future inflation have stabilized, and wage pressures have moderated. Imported inflation has decreased due to lower commodity prices and reduced consumer price inflation in Jamaica’s main trading partners. Despite adverse weather affecting agricultural supplies in late 2024, which temporarily increased food prices, headline inflation returned to the target range after a brief breach in August 2024.

Future Projections: The MPC projects that inflation will remain within the target range over the next two years, assuming no new shocks. This projection is based on the expectation that internal and external inflation drivers will continue to support low, stable, and predictable inflation. However, there are upside risks to this projection, particularly due to uncertainties in the economic policies of Jamaica’s main trading partners.

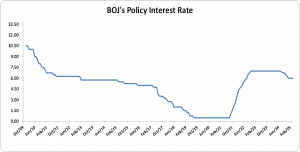

Global Economic Outlook: The MPC discussed the impact of recent trade policy adjustments announced by the United States and retaliatory measures by countries like China and Canada. These policies could affect imported inflation for Jamaica. The US Federal Reserve’s decision to maintain its interest rate target at 4.25% to 4.50% in March 2025 also influenced the MPC’s deliberations.

Policy Decisions: In light of these developments, the MPC unanimously agreed to maintain the policy rate at 6.00% per annum and to preserve relative stability in the foreign exchange market.

Disclaimer:

Analyst Certification – The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer(s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view(s) expressed by that research analyst in this research report.

Company Disclosure – The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.