August 20, 2025

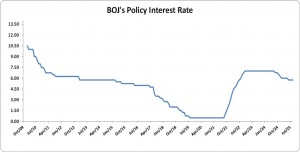

The Bank of Jamaica’s (BOJ) Monetary Policy Committee (MPC), at its meetings on 18 and 19 August 2025, decided to maintain its current monetary policy stance, keeping the policy interest rate at 5.75% per annum. This decision reflects the Committee’s view that the existing policy is appropriate to support inflation remaining within the target range of 4.0% to 6.0% over the next two years, despite persistent global uncertainties. These include evolving U.S. economic policies, tightening immigration rules, and potential disruptions in international trade, which could elevate inflation risks.

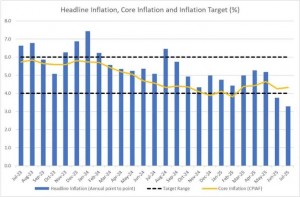

Inflation in Jamaica has generally remained within the target range since March 2024. As of July 2025, annual headline inflation was 3.3%, below the lower bound of the target and lower than the previous year’s outturn. Core inflation stood at 4.3%, also below the July 2024 level. The decline in headline inflation was largely attributed to falling energy prices, the non-repetition of public transportation fare increases, a reduction in the General Consumption Tax (GCT) on electricity and improved agricultural supplies. Inflation expectations have remained stable, and imported inflation moderated in the June 2025 quarter. However, the BOJ anticipates that inflation will remain below the lower bound of the target in the short term before trending toward the midpoint, driven by temporary factors such as improved agricultural output and lower electricity costs.

The MPC also evaluated the broader economic outlook, projecting real GDP growth between 1.0% and 3.0% for FY2025/26, supported by positive performance in the Agriculture, Mining, and Tourism sectors. Growth is expected to normalize to a range of 1.0% to 2.0% thereafter. Indicators point to resilience in the domestic economy, with continued growth in remittance inflows and improved tourism arrivals in the June 2025 quarter. The current account remains in surplus, and international reserves reached a historic high of US$6.1 billion as of July 2025. Employment levels are high, and wage pressures appear to be easing. The domestic banking system remains sound, with adequate capital and liquidity, and fiscal policy is not expected to pose inflationary risks in the near term.

Internationally, inflation in the United States decelerated to 2.7% in June 2025, down from 3.0% a year earlier. The Federal Reserve maintained its policy rate at 4.25%–4.50% in July 2025, anticipating a slowdown in output and signalling potential rate reductions toward the end of the year. Commodity price movements were mixed: average oil and grain prices declined, while liquefied natural gas (LNG) prices rose due to increased U.S. export demand. Shipping costs also fell year-over-year. The Jamaican dollar depreciated by 1.3% against the U.S. dollar during the June quarter, driven by temporary factors, but was stabilized through BOJ’s foreign exchange interventions totalling US$345 million.

In conclusion, the BOJ reaffirmed its commitment to maintaining low and stable inflation and pledged to continue monitoring economic developments closely. The next monetary policy decision is scheduled for 29 September 2025.

Disclaimer:

Analyst Certification – The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer(s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view(s) expressed by that research analyst in this research report.

Company Disclosure – The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.