July 1, 2024

The Monetary Policy Committee (MPC) of the Bank of Jamaica (BOJ) met on June 26-27, 2024, and reviewed its recent monetary policy measures, a three-pronged approach which included:

- Policy Rate Increases: Raising the policy rate by 650 basis points to 7.0%.

- Tightened Liquidity: Utilizing open market operations to control liquidity, raising private money market interest rates.

- Foreign Exchange Stability: Utilized its foreign reserves to maintain relative stability in the foreign exchange market.

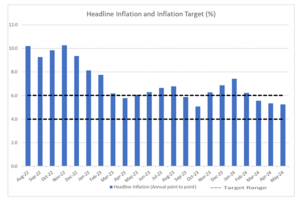

These actions were aimed at combating high inflation, which peaked at 11.8% in April 2022. Recent data shows significant progress, with headline inflation at 5.2% in May 2024, within the target range (4.0-6.0%) for three consecutive months. Core inflation also showed a downward trend.

Factors contributing to this success include stable exchange rates, reduced domestic demand, and lower imported inflation. Inflation expectations and wage pressures have moderated, and the balance of payments remains strong.

Considering the improved inflation outlook, the MPC decided to start gradually easing monetary policy by reducing liquidity absorption, promoting credit growth, and potentially lowering market rates. However, at present, the MPC decided to maintain the policy rate at 7.0% and to continue its proactive stance of preserving relative stability in the foreign exchange market.

The Jamaican economy is growing, with GDP estimated to have grown within the range of 1.5% to 2.5% in early 2024, and inflation projections generally within target. External factors, such as US inflation and global economic conditions, were also considered. The US Fed maintained its interest rates, and various commodity prices showed mixed trends.

Overall, the MPC’s future decisions will be data-driven, with further easing possible if inflation remains stable.

Source: Bank of Jamaica

Disclaimer:

Analyst Certification – The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer(s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view(s) expressed by that research analyst in this research report.

Company Disclosure – The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.