December 23, 2024

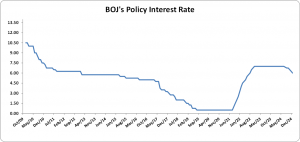

The Bank of Jamaica’s (BOJ) Monetary Policy Committee (MPC) decided to reduce the policy rate by 25 basis points to 6.00% per annum, effective December 23, 2024. This marks the fourth consecutive rate reduction in 2024, reflecting the MPC’s assessment that the economic environment supports further easing. The decision is based on inflation being anchored within the target range, despite recent adverse weather impacts on prices.

As of November 2024, annual headline inflation was 4.3%, down from 7.4% in January 2024. Core inflation, which excludes volatile items like agricultural food products and fuel, was 4.2%, marking the seventeenth consecutive month below 6.0%. The deceleration in inflation is attributed to stability in key drivers such as the foreign exchange market and private sector inflation expectations. Additionally, wage pressures moderated, and there were no significant increases in administered prices.

Looking ahead, the BOJ expects inflation to remain within its target range over the next eight quarters. However, there are upside risks due to potential changes in economic policies among Jamaica’s main trading partners, though the timing and extent of these changes are uncertain. The MPC believes the current policy stance is appropriate but notes that high interest rates on bank loans suggest room for downward adjustments.

Despite the positive inflation trends, the BOJ acknowledges that consumer prices remain high. The Bank remains committed to maintaining low, stable, and predictable inflation, which is its primary mandate. The MPC will continue to monitor inflation closely and adjust its policy stance as necessary to ensure economic stability.

Source: Bank of Jamaica

Disclaimer:

Analyst Certification – The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer(s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view(s) expressed by that research analyst in this research report.

Company Disclosure – The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.