May 21, 2025

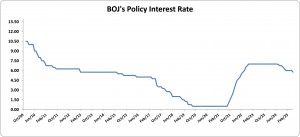

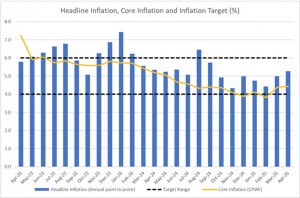

In its May 2025 monetary policy release, the Bank of Jamaica (BOJ) announced a reduction in its policy interest rate by 25 basis points, bringing it down from 6.00% to 5.75%. This decision reflects the central bank’s confidence in the continued stability of inflation, which has remained within the target range of 4.0% to 6.0% since September 2024. The BOJ emphasized that this move is intended to support economic growth while preserving macroeconomic stability, signaling a cautiously optimistic stance on the country’s economic trajectory.

Inflation data as of April 2025 showed headline inflation at 5.3%, consistent with the same period in the previous year. Core inflation, which excludes volatile items such as food and fuel, was recorded at 4.4%, remaining below the upper limit of the target range since mid-2023. The BOJ attributed this inflation stability to the absence of increases in regulated prices, such as public transportation fares, which helped counterbalance rising food costs. Looking ahead, the central bank expects inflation to trend toward the lower half of the target range over the next two years, assuming that inflation expectations remain anchored and global oil prices decline moderately.

On the broader economic front, Jamaica’s real GDP is projected to grow in 2025, supported by a rebound in key sectors such as mining, tourism, and construction. Employment levels remain high, although wage pressures appear to be easing, which could help contain inflationary risks. The external sector also remains robust, with the current account of the balance of payments expected to stay in surplus and international reserves continuing to strengthen.

However, the BOJ also highlighted emerging global risks, particularly those stemming from policy shifts in the United States. These include changes in trade relations, tighter immigration policies, and uncertainty surrounding a new fiscal package for the 2025/26 fiscal year. Such developments could dampen global economic activity and exert upward pressure on inflation, potentially affecting Jamaica’s economic outlook. Despite these uncertainties, the BOJ’s latest policy move reflects a measured approach to fostering growth while maintaining economic stability.

Disclaimer:

Analyst Certification – The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer(s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view(s) expressed by that research analyst in this research report.

Company Disclosure – The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.