Revenue increased by 15%, year over year, totaling $1.40 billion as sales from the Lumber division increased by 11% while sales from the soap division rose by 24%. While for the fourth quarter Revenue was up 11% to total $346.67 million relative to the $310.98 million booked in 2016.

BPOW noted, “In the domestic market, a large number of retail outlets now carry our products and it is not as difficult as it used to be to find Blue Power products on the shelves of supermarkets and other types of shops although the majority of bathing soaps on the shelves are imported. We have achieved this while maintaining our special relationship with wholesalers in Kingston who tend to move substantial quantities of product by supplying smaller shops and street vendors. In the export arena, we have continued to support the distributors of Blue Power products who have shown improved results. In addition, we have established relationships with three local distributors who acquire their branded products from us for export. At the same time, the Lumber Division continues to efficiently provide materials needed for construction by small contractors and large firms.”

Cost of Sales showed an increase of 11%, moving from $962.52 million to $1.07 billion. As such, Gross Profit amounted to $327.28 million, an increase of 29% on the $253.11 million recorded last year. For the fourth quarter Cost of Sales increased by 14% amounting to $284.30 million (2016: 248.44 million), resulting in a marginal decline in Gross Profit to $62.38 million (2016: $62.54 million).

Administrative Expenses saw an increase of 19%, totaling $216.92 million relative to last year’s $181.95 million.

Other income, for the year end totaled $8.23 million a 120% growth when compared to the $3.74 million recorded for the same period last year.

Finance Cost of $4.32 million was recorded compared to $4.27 million in the year prior, while Finance Income totalled $25.24 million relative to the $14.82 million in 2016. Consequently, Profit before taxation reflected a 63% increase year over year to $139.51 million versus $85.46 million booked for the prior year.

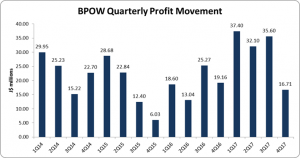

After taxation of $17.69 million (2016: $9.38) Net Profit amounted to $121.82 million compared to $76.07 million, a 60% growth. Net Profit for the fourth quarter was down 13% to total $16.71 million in contrast to $19.16 million reported in the corresponding period last year.

Earnings per share for the period totaled $2.16 (2016: $1.35), while for the quarter the EPS was $0.30 (2016: $0.34). The number of shares used in this calculation was 56,499,000 shares.

Balance Sheet at a glance:

As at April 30, 2017, total assets amounted to $757 million, up $115.77 million from the balance of $641.23 million as at April 30, 2016. The largest contributor to the increase in assets was Property Plant and Equipment which closed the period at $114.03 million (2016: $63.55 million).

Shareholders’ Equity increased by approximately 20% amounting to $673.19 million (2016: $560.65 million) with a book value per share of $11.91 (2016: $9.92).

Disclaimer:

Analyst Certification -This research report is for information purposes only and should not be construed as a recommendation. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.