March 11, 2021

CAC 2000 Limited (CAC) revenues for the first quarter ended January 31, 2021 declined 17% to $253.33 million relative to $306.57 million for the comparable period in 2020. CAC noted, “We partner with our customers to identify solutions such as fresh air injection systems, higher efficiency filtration, sterilization and improved maintenance services, all of which gained us additional revenues.”

Cost of sales also fell by 27% for the period to $140.06 million (2020: $191.76 million). Consequently, gross profit for the quarter amounted to $113.27 million (2020: $114.81 million).

The Company reported a 7% reduction in Total Expenses to $96.65 million (2020: $105.78 million). This was as a result of a 32% decline in selling & distribution to $4.74 million (2020: $7.01 million). CAC stated, “Expenses were kept lower than the previous year as we took rapid action to respond to COVID-19 by reducing operating costs, but without making any of our staff members redundant.” Also, general administrative expenses fell by 7% to $91.91 million for the first quarter, relative prior year’s corresponding quarter of $98.77 million.

No Other Income was recorded for the period, relative to the $5,000 reported for the same period the prior year. Consequently, Profit before Taxation and Finance Cost amounted to $16.62 million compared to a profit of $9.03 million experience in the first quarter of 2020.

Net Finance Costs rose 12% for the period under review, to end at $8.68 million (2020: $7.72 million).

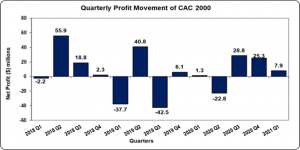

Profit before taxation improved significantly for the first quarter to close at $7.94 million relative to the $1.31 million booked in 2020. No taxes were recorded for the period, thus net profit for the quarter amounted to $7.94 million relative to the profit of $1.31 million reported for the same quarter ended January 31, 2020.

Earnings-per-share (EPS) for the first quarter amounted to $0.06 compared to a loss per share of $0.01 in 2020. The trailing twelve months earnings per share amounted to $0.30. The number of shares used in our calculations is 129,032,258 units. Notably, CAC’s stock price closed the trading period on March 10, 2021 at a price of $8.86 with a corresponding P/E ratio of 29.19 times.

The company highlighted that, “We have started the new financial year with a healthy job portfolio and are working on some exciting changes, and initiatives as we strategically set upon the path to profitable growth as the leading experts on energy and IEQ all for the purpose of “Improving People’s Lives”.

Balance Sheet at a glance:

As at January 31, 2021 the Company reported total assets of $1.10 billion, a 7% decrease when compared to $1.18 billion as at January 31, 2020. This was as a result of ‘Cash and Bank Deposits’ which decreased by 55% to $88.28 million (2020: $195.34 million). Additionally, ‘Due from related parties’ closed at $15,963 compared to $28.26 million reported as at January 31, 2020.

Shareholders’ Equity as at January 31, 2021 was $396.28 million (2020: $368.26 million), an 8% increase year over year. This resulted in a book value per share of $3.07 (2020: $2.85).

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.