March 02, 2020

Caribbean Flavours and Fragrances (CFF), revenues increased to $462.46 million for the twelve months ended December 31, 2019. Cost of sales amounted to $323.30 million. Management noted, “the company faced significant increase in logistics costs and increases from suppliers this resulted in substantial increases in cost of sales.” Consequently, gross profit amounted to $139.16 million for the year end.

The Company recorded a year over year increase in total expenses to $117.24 million. Total expenses comprised of selling and distribution which totalled $3.40 million, whereas, administrative expenses for the period closed at $113.84 million.

Consequently, profit from operations for the period closed at $21.92 million.

Finance income for the year amounted to $15.41 million, while finance cost closed at $520,000. As such, pre-tax profit amounted to $36.81 million for the year ended December 31, 2019.

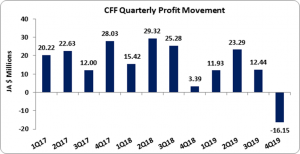

Consequently, after incurring taxation of $5.31 million (2018: $19.29 million), net profit for the period amounted to $31.50 million. Management noted, “outcomes from our strategy implementation and investment in the sugar reduction product portfolio was co-dependent on the introduction of a concurrent regulatory framework and enforcement regime. While the buy-in came from the number of local and regional players in the market, the regulatory framework and enforcement mechanisms to be instituted by the Government were delayed, which negatively impacted the returns we had projected from the market.”

CFF also stated, “we are committed to constantly seeking new ways to become more innovative and efficient and to diversify our product offerings and our markets. We ae building on the small successes in the export markets and will continue to expand this area of business.”

The earnings per share for the year amounted to $0.35. The number of shares used in this calculation was 89,920,033 units. As at February 28, 2020 the stock traded at $14.64.

Balance Sheet Highlights:

CFF, as at December 2019, recorded total assets of $563.22 million, an increase of 19% when compared to $474.47 million for the prior year. ‘Property, Plant & Equipment’ and ‘Inventories’ contributed to this growth, closing the period at $99.63 million (2018: $21.20 million) and $166.90 million (2018: $130.86 million), respectively. ‘Investment’ also contributed to the growth amounting to $214.11 million (2018: $154.42 million).

Total Shareholders’ Equity as at December 2019 closed at $439.27 million, an improvement of 3% from $427.16 million last year. This resulted in a book value per share of $4.89 (2018: $4.89).

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.