February 12, 2024

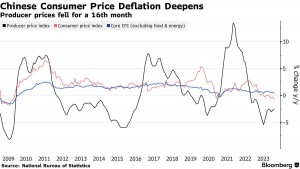

- Producer prices fall for 16th month in sign of weak demand.

- China has been beset by falling prices for much of last year

China’s consumer prices fell last month at the fastest pace since the global financial crisis, piling pressure on the government to step-up support for a stumbling economic rebound that’s roiling markets.

The consumer price index dropped 0.8% in January from a year ago, the National Bureau of Statistics said Thursday, the weakest since September 2009. The drop was worse than economists’ expectations for a 0.5% decline.

“The CPI data today shows China faces persistent deflationary pressure,” said Zhiwei Zhang, president and chief economist at Pinpoint Asset Management Ltd. “China needs to take actions quickly and aggressively to avoid the risk of deflationary expectation to be entrenched among consumers.”

The producer price index fell 2.5%, marking 16 straight months of deflation for factory-gate costs.

The latest data comes as calls mount for China to do more to stimulate the economy and reverse a stock market slide. Confidence in the world’s second-largest economy has flagged despite efforts by the government to add stimulus, including measures such as unleashing long-term cash for banks and issuing more government bonds to fund construction projects.

China has also taken a slew of moves to arrest the $5 trillion equities selloff. President Xi Jinping was set to get a briefing from regulators on the rout, Bloomberg News reported earlier this week. Underscoring the urgency, Beijing ousted the head of the nation’s main securities regulator, sending shockwaves across the industry.

The benchmark CSI 300 Index rose 0.4% on Thursday, in line for a fourth day of gains. The yuan was little changed at 7.1945 per dollar.

China in Deflation

- GDP deflator was negative for last three quarters of 2023.

China has been beset by falling prices for much of the last year as the nation struggles to revive domestic demand and consumer confidence. A measures of economy-wide prices marked its longest slide since 1999 in the fourth quarter, underscoring the magnitude of the challenge as policymakers look to boost growth this year.

What Bloomberg Economics Says…

“The report drives home a message — the economy needs aggressive policy steps to boost demand and shake confidence out of its torpor. The People’s Bank of China has signaled that fighting deflation is a priority and looks set to deliver more stimulus. The question is, how forceful it will be — and whether banks pass on the easing in the form of more and cheaper credit.”

– Eric Zhu, economist

Core CPI, which strips out volatile food and energy costs, rose 0.4%, slower than December and the weakest rise since June last year. Pork prices dropped 17%, helping drag down food prices by 5.9%, which was the biggest decline on record in data back to 1994.

The risks from deflation are serious. If China is unable to meaningfully turn the trend around, it risks leading to a downward spiral with people holding off on purchases due to expectations prices would continue falling. That would dent overall consumption and spill over to businesses.

(Source: Bloomberg)

Disclaimer:

Analyst Certification – The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer(s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view(s) expressed by that research analyst in this research report.

Company Disclosure – The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.