Date: August 30, 2019

In United States dollars (except where it is indicated otherwise):

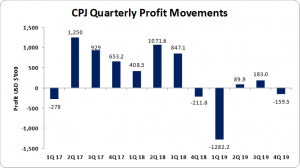

Caribbean Producers Jamaica Limited (CPJ) for the year ended June 30, 2019 reported a 2% growth year on year in gross operating revenues to close at $109.62 million compared to the $107.80 million for the prior year. For the fourth quarter the company posted a 7% growth in revenues to close at $27.88 million relative to $26.15 million for the same quarter of 2018.

Cost of goods sold showed a 5% increase closing the period at $83.40 million relative to $79.37 million for the previous year. For the quarter the company recorded a 13% increase in cost of goods sold to close at $22.56 million relative to $19.99 million for the comparable period in 2018. Consequently, CPJ recorded an increase in gross profit to $26.22 million (2018: $28.43 million). Gross profits for the quarter however fell from $6.15 million in 2018 to $5.32 million.

Additionally, Management highlighted that the Company “experienced a critical failure at implementation of new IT system at the start of the FY. This event resulted in significant variable and one-off costs, along with lost bids and annual contract opportunities for servicing its core business, the hotel and food service markets. The impact and recovery extended throughout the first 3 quarters which correlated with the peak tourism season. The logistic challenges created excessive delays and challenges for smooth procurement and delivery capability to fulfil demand.”

Selling and administrative expenses were $22.86 million, a 4% increase on the $21.95 million posted last year.

Depreciation for the year was relatively unchanged when compared to the corresponding prior year to close at $2.47 million (2018: $2.46 million).

Other operating income totaled $175,059; this compares with an operating income of $99,145 booked a year ago.

Profit before finance costs, income and taxation decreased by 74% to total $1.07 million relative to $4.12 million in 2018.

Finance income amounted to $569 (2018: $191,791), while Finance cost was unchanged at $1.68 million (2018: $1.67 million). As such loss before taxation was $1.29 million compared to a profit of $2.64 million in 2018.

Net loss for the financial year amounted to $1.17 million compared to a net profit of $2.31 million booked in 2018 following tax benefit of$117,354 (2018 tax charge: $327,439). On the other hand, net loss for the quarter amounted to $185,654 relative to a net loss of $231,663 booked last year.

Net loss attributable to shareholders for the year amounted to $1.17 million, this compares with the net profit attributable to shareholders of $2.10 million booked twelve months earlier.

As a result, loss per share (LPS) for the year amounted to US$0.1063 cents compared to EPS US$0.1908 cents in 2018. LPS for the quarter amounted to US$0.02 cents relative to a similar loss per share of US$0.02 cents. The number of shares used in our calculations amounted to 1,100,000,000 units. CPJ’s stock price closed the trading period on August 29, 2019 at a price of $4.78.

CPJ’s also stated, “FY2019 presented the Company with multiple challenges to navigate the disruptive impact to business during its most sensitive earning season. The experience enabled the Company to strengthen a number of critical areas of the business including process reengineering and the introduction of the new technical talent at the senior management and board level.”

CPJ further noted, “the core business model remains resilient and the introduction of new delivery and procurement capabilities creates opportunities for greater efficiency and economies of scale. Also, the introduction of new product categories, combined with the planned incremental growth of hotels on the island over the next 3 years also presents an attractive growth trajectory.”

Furthermore, Management noted that “ the launch of the new Distribution Centre is projected to enable higher operational efficiencies and ultimately support long term value in our ability to fulfill greater demands that will be required to support the growth of the hotel industry.

Balance Sheet Highlights:

As at June 30 2019, CPJ’s total assets amounted to $67.47 million, a 16% uptick year over year from the $58.39 million as at June 30, 2018. The increase was due mainly to growths in ‘Inventories’ which jumped 23% to $31.87 million versus $25.91 million reported in 2018. ‘Properties and Plant’ also contributed to the upward movement in the asset base with a 21% increase to $14.30 million from $11.78 million in 2018.

Shareholder’s Equity as at June 30, 2019 totalled at $21.971 million (2018: $23.51 million) resulting in a book value per share of approximately US$0.02 cents (2018: US$0.021 cents).

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.