For the first quarter ended March 31, 2017, Cable & Wireless Jamaica Limited (CWJ) reported revenue for increased by 10% to $6.38 billion relative to $5.81 billion in 2016. The CEO, Garfield Sinclair, attributed the increase to, “a 17% increase in Mobile revenues.” Additionally, he states that “This growth in our mobile business both in revenue and revenue share reflects the continuing customer migration from fixed to voice and data services.” Their highly successful broadband expansion program that will see additional communities or approximately 60,000 homes benefitting from access to high speed internet that will ultimately improve subscriptions. Mr Sinclair also stated “C&W Business segment had a flat revenue performance was impacted by a slower order period right after the Christmas holiday break”.

Operating costs before depreciation and amortization increased in 2017 by 36% to $4.50 billion up from $3.31 billion in 2016. According to CWJ, “this was due to a 46% increase in out payments and direct costs and a 30% net increase in employee, administration, marketing and selling expenses, driven by higher management fee and royalty fees.”

Depreciation of for the quarter amounted to $730 million compared to $1.25 billion a year ago. Amortization year over year decreased 20% from $333 million to $265 million.

As a result profit before exceptional items decreased by 66% in 2017 to $879 million when compared to the 2016 figure of $2.56 billion.

Finance income declined by 84% from $94 million to $15 million for the first quarter of 2017. Finance expenses increased by 57% to $1.32 billion in 2017 relative to $838 million in 2016.

Loss before taxation for the first quarter amounted to $421 million relative to a profit of $1.82 billion for the corresponding period in 2017.

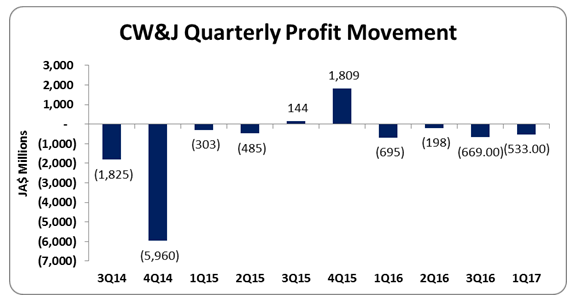

Consequently, net loss for the period amounted to $533 million compared to a profit of $1.81 billion a year earlier. The loss per share for the three month period amounted to $0.03 versus an earnings per share of $0.11. The twelve months trailing EPS is $0.02, the number of shares used in this calculation was 16,817,439,740.

Balance Sheet Highlights:

The company, as at March 31, 2017, recorded total assets of $37.85 billion, a decrease of 3% relative to $39.12 billion for the corresponding period in 2016.

Total Stockholders’ deficit as at March 30, 2017 closed at $30.43 billion versus $29.89 billion reported. This resulted in a book value of -$1.81 compared to a 2016 value of -$1.78.

Please note that the CWJ board changed the company’s accounting terminal date from March 31st to December 31st so that CWJ’s financial year-end would be conterminous with that of Liberty Global, to achieve uniformity throughout the group.

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.