May 1, 2020

Express Catering Limited (ECL) for the nine months ended February 29, 2020 reported a 7% increase in revenue to US$12.91 million (2019: US$12.11 million). Revenue for the quarter advanced 3% to close at US$5.10 million relative to US$4.93 million reported the previous year. Notably, the company stated, “We constantly benchmark our revenue growth target to be within the rate of passenger growth.” Management also noted, “the total number of departing passengers grew marginally at below 2.0% for the period.”

Cost of sales (COS) increased by 9% for the period to US$3.55 million (2018: US$3.25 million). Gross profit increased year-on-year for the nine month period by 6%, from US$8.86 million in 2019 to US$9.36 million in 2020. Gross profit for the third quarter improved from US$3.61 million in 2020 to US$3.67 million, a 2% increase year over year. The company states, “Product mix during the Quarter created some pressure on the Cost of Sales.”

Furthermore, “Cost of Sales experienced some negative pressure during the Quarter and YTD due to product mix variations. These, however, were within acceptable ranges. Variations in the product mix along with changes in the product category composition will result in marginal changes. Administration and general expenses were, for the most part, in line with prior ratios. The increase in maintenance cost midway in the prior half year distorted the comparison and resulted in a marginal increase in current year expense ratio.”

Total expenses increased by 6% for the period in review to US$6.40 million, up from US$6.04 million booked for the nine months ended February 2019. The increase was associated with a 6% growth in administrative expenses to US$5.94 million from US$5.59 million. Depreciation and Amortization saw a marginal increase to US$417,825 compared to US$415,946 for the comparable period in 2019. Promotional expenses saw a 26% increase from US$36,108 in 2019 to US$45,452. Total expenses for the quarter increased 1% to close at US$2.43 million (2019: $2.40 million).

Consequently, operating profit for the period increased by 5% to US$2.95 million (2019: US$2.81 million). However, operating profit for the quarter totalled US$1.24 million, up 3% relative to US$1.21 million booked for the corresponding quarter of 2019.

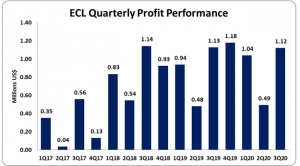

Finance cost of US$259,229 (2019: US$259,075) was incurred for the period, while foreign exchange losses amounted to US$45,254 (2019: FX losses: US$8,463). Consequently, profit for the period amounted to US$2.65 million, a 4% increase above the US$2.55 million recorded for the corresponding period in the prior year. For the quarter, profit amounted to US$1.12 million versus US$1.13 million booked for the comparable period in 2019, a 1% decrease.

Earnings per share (EPS) for the nine months totaled US 0.162 cents (2019: US0.156 cents). Earnings per share for the quarter amounted to US0.068 cents (2019: US0.069 cents). The number of shares used in the calculation was 1,637,500,000 units. Notably, ECL’s stock price closed the trading period on May 1, 2020 at a price of JMD$3.20.

ECL noted, “since the close of the third quarter in February, a pandemic was declared worldwide as a result of the effects of the Corona virus, Covid-19. This has brought air travel to almost a halt, with only emergency and travel for economic purposes being allowed. The outlook is for some return to normalcy by June 2020 and so the company is ensuring that, when that time arrives, all is in place to service the many expected travelers.”

Balance Sheet Highlights:

The company, as at February 29, 2020, recorded total assets of US$10.67 million. Notably, ‘Owing by related companies’ as at February 29, 2020 increased by $2.80 million, while ‘Cash and Bank Balances’ rose by US$204,679. ‘Owing by related companies’ closed the period at $US$4.32 million (2019: US$1.52 million), while ‘Cash and bank balances’ amounted to $US462,831 relative to US$258,152 for the same period in 2019. ECL highlighted, “Fixed Assets expenditure during the Quarter was US$56,000 to take the YTD total to US$114,000. This was expended across various categories and was mainly for replacement and upgraded purposes.”

Total Stockholders’ equity as at February 29, 2020, closed at US$5.46 million (2019: US$3.21 million); this resulted in a book value of US$0.33 cents (2019: US$0.20).

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.