April 11, 2023

Revenue increased 58% to US$15.15 million (2022: US$9.61 million). For the quarter, revenue increased 73% to US$6.04 million (2022: US$3.48 million). Management noted that this is the highest quarterly revenue recorded since inception.

Cost of sales (COS) increased 61% to US$5.26 million (2022: US$3.28 million). Consequently, gross profit increased 56% to US$9.89 million (2022: US$6.33 million). For the quarter, gross profit increased 79% to US$4.03 million (2022: US$2.25 million).

Total expenses increased 23% to US$6.31 million (2022: US$5.13 million). The growth was associated with a 32% increase in administrative expenses to US$4.07 million (2022: US$3.08 million). For the quarter, total expenses increased 37% to US$2.28 million (2022: US$1.67 million).

Consequently, operating profit increased 198% to US$3.60 million (2022: US$1.21 million). For the quarter, operating profit increased 201% to US$1.75 million (2022: US$581,248).

Finance income declined 53% to US$292 (2022: US$615), while finance cost and foreign exchange losses increased 6% and 486% to US$1.66 million (2022: US$1.56 million) and US$14,269 (2022: US$2,434).

Pre-tax profit increased 429% to US$1.93 million (2022: US$364,507). There were no tax charges for the period.

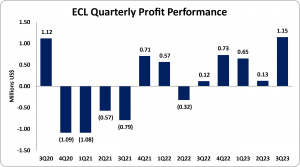

As such, net profit amounted to US$1.93 million (2022: US$364,507). For the quarter, net profit increased 854% to US$1.15 million (2022: US$120,248). Management noted that this is the highest quarterly net profit recorded since inception.

Earnings per share (EPS) amounted to US0.118 cents (2022: US0.022 cents). For the quarter, EPS amounted to US0.070 cents (2022: US0.007 cents). The number of shares used in the calculation was 1,637,500,000 units. Notably, ECL’s stock price closed the trading period on April 6, 2023 at J$4.72 with a corresponding P/E ratio of 18.91 times.

Management noted that the completion of the food court expansion continues at a brisk pace; the recently opened Guitar Bar has been getting rave reviews and work continues on the Bob Marley One Love experience.

Balance Sheet Highlights:

Total assets as at February 28, 2023 increased 6% to US$42.53 million (2022: US$40.07 million). This upward movement is primarily attributable to a 32% increase in ‘Owing by related companies’, which closed at US$12.40 million (2022: US$9.36 million), tempered by a 9% decline in ‘Right-of-use asset’ to US$22.41 million (2022: US$24.63 million).

Total Stockholders’ equity as at February 28, 2023 increased 102% to US$5.26 million (2022: US$2.61 million); this resulted in a book value of US0.32 cents (2022: US0.16 cents).

Disclaimer:

Analyst Certification – The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure – The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may affect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.