June 7, 2024

For the end of 2023, the European Central Bank (ECB) has updated its dataset of structural financial indicators for the EU banking industry. This yearly dataset includes information on the number of branches and staff members of EU credit institutions, as well as data on the concentration of the banking industry in each Member State and data on institutions under foreign controlled institutions that operate inside the EU.

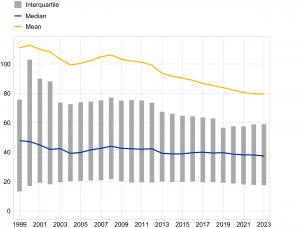

The number of bank offices in the EU is declining further, with an average decrease of 3.09% across Member States, according to structural financial indicators. Of the 27 countries, 24 saw decreases, ranging from -0.17% in Spain to -12.46% in Belgium. By the end of 2023, there were 129,418 offices in the EU, with 82.2% of them being in the euro area.

Over the course of 2023, bank employment decreased in 15 of the 27 Member States, with a global average decline of 0.81%. There appears to have been a plateau in the decrease of bank employment that has been seen in the majority of Member States since 2008.

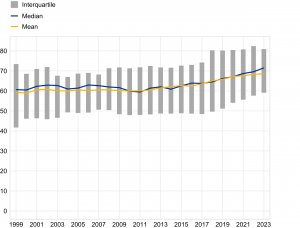

Additionally, the statistics show that there are still significant differences in the level of banking sector concentration among EU Member States, as determined by the percentage of assets owned by the five largest banks. By the end of 2023, the five biggest credit institutions in each country had a total asset share ranging from 32.34% (Luxembourg) to 95.58% (Greece), compared to the EU average of 68.6%.

Number of employees of credit institutions in the EU

Share of assets held by the five largest banks

(Source: European Central Bank)

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer(s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view(s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.