Euro Area

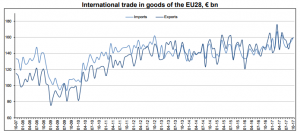

Based on the first estimate from Eurostat for the euro area (EA19) exports of goods to the rest of the world in October 2017 amounted to €187.9 billion, up 8.8% versus €172.6 billion for October 2016. Imports from the rest of the world stood at €168.9 billion, an increase of 10.1% relative to October 2016 (€153.4 billion). Consequently, the euro area posted an €18.9 billion surplus in trade in goods with the rest of the world in October 2017. This compared to a surplus of €19.2 billion for the corresponding period in 2016.

Between January 2017 and October 2017, the euro area exports of goods to the rest of the world totaled €1,812.6 billion, while imports stood at €1,624.7 billion. According to Eurostat, “the euro area recorded a surplus of €187.9 billion, compared with €213.8 billion in January-October 2016. Intra-euro area trade rose to €1 529.3 billion in January-October 2017, up by 7.6% compared with January-October 2016.”

EU28

Estimates for the EU28 reflected exports of goods in October 2017 amounted to €159.4 billion, 8.6% more than the €146.8 billion recorded for October 2016. The EU28 imports for October 2017 rose 10.6% to €159.6 billion (October 2016: €144.4 billion). As a result the deficit for October 2017 was €0.3 billion compared to a surplus of €2.4 billion in October 2016.

Between January 2017 – October 2017, export for the EU28 amounted €1,549.7 billion, up 8.95 compared to the similar period in 2016. Imports for the same period amounted to €1,544.5 billion, 9% above the corresponding period in 2016. This resulted in a surplus of €5.2 billion (January 2017 – October 2017: €5.3 billion)

The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.