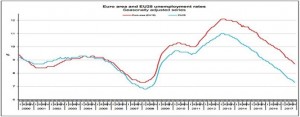

The Eurostat- the statistical office of the Eurozone reported an unemployment rate for November 2017 for the Euro area (EA19) of 8.7%. This represent a slight decrease from the preceding October 2017 unemployment rate of 8.8%, and a 1.1% fall from the corresponding period of November 2016, when unemployment rate was a high of 9.8%.

The broader Euro area (EU28) also posted a decline in unemployment, albeit at a lower level, moving from 7.4% to 7.3% from October to November 2017. This reflects a fall of 1% when compare to November 2016.

Member States

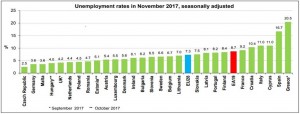

Among the Member States, the lowest unemployment rates in November 2017 were recorded in the Czech Republic (2.5%), Malta and Germany (both 3.6%). The highest unemployment rates were observed in Greece (20.5% in September 2017) and Spain (16.7%). Compared with a year ago, the unemployment rate fell in all Member States for which data is comparable over time. The largest decreases were registered in Greece (from 23.2% to 20.5% between September 2016 and September 2017), Portugal (from 10.5% to 8.2%), Croatia (from 12.5% to 10.4%) and Cyprus (from 13.1% to 11.0%).

Youth Unemployment

Unemployment among youth ( under 25) decreased across the region. Compared with November 2016, youth unemployment decreased by 429 000 in the EU28 and by 286 000 in the euro area to a rate of 16.2% and 18.2% respectively. In November 2017, the lowest unemployment rates among youth were observed in the Czech Republic (5.0%) and Germany (6.6%), while the highest were recorded in Greece (39.5% in September 2017), Spain (37.9%) and Italy (32.7%).

The below graph depicts the unemployment rate for individual country within the Euro area, adjusted for seasonality.

Source: Eurostats

The graph below shows the movement of unemployment rate for the Euro area from 2000- 2017

Source: Eurostats

The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.