April 20, 2021

The Jamaican economy experienced a rapid depreciation in the exchange rate during 2020 due to the pandemic’s impact on key sectors. The exchange rate in 2020 closed at JMD $142.65 to USD $1.00, after opening the year at JMD $132.57, resulting in a 7.6% depreciation. Over the past twelve months, the central bank has implemented numerous initiatives to provide liquidity to and ensure the continued smooth functioning of the foreign exchange market. BOJ conducted B-FXITT intervention sales, directly sold FX to major players in the energy sector, reduced the foreign currency cash reserve requirement, introduced FX swap arrangements, and provided US dollar bond repurchase facilities. In February 2021, Richard Byles, Governor of The Bank of Jamaica (BOJ), stated, “Overall, inflows into the foreign exchange market have remained healthy. Between March 2020 and January 2021, daily purchases of US dollars by authorised dealers and cambios from end users averaged US$31.2 million, slightly lower than the average of US$33.4 million recorded last year. Similarly, daily sales to end users averaged US$27.7 million over March 2020 to January 2021, slightly lower than the average of US$29.0 million a year earlier.”

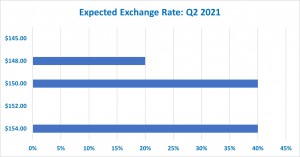

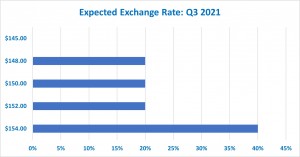

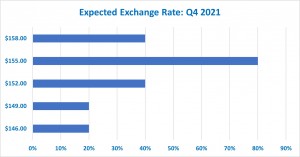

The Exchange rate opened the 2021 calendar year at JMD $142.65 to USD $1.00 and has since devalued by approximately 6.7% to JMD $152.13 as of April 19, 2021. The monthly weighted average selling exchange rate at the end of March 2021 2021 was JMD $147.86, while the buying rate was JMD $146.27. Based on the FX survey conducted, the anticipated exchange rate at the end of the following quarters in 2021 are:

Q2 2021:

Q3 2021:

Q4 2021:

Disclaimer

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.