Brent Oil

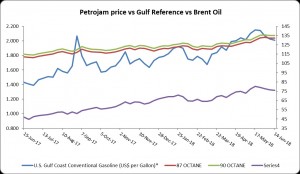

Brent oil prices decreased by 0.48 % or US$0.37, as prices fell this week. Oil traded on June 14, 2018 at a price of $76.08 per barrel relative to US$76.45 last week. Brent oil began the year at US$68.07 per barrel.

Petrojam prices

87 Octane prices decreased week over week, by 0.16% (JMD$0.21). Additionally 90 Octane declined by 0.16% or (JMD$0.21) week over week. 87 Octane and 90 Octane opened the year at J$121.04 and J$123.88 respectively and now trades at J$132.12 and J$134.96 per litre respectively.

Figure 1: Petrojam, U.S. Gulf Coast Conventional Gasoline Regular and Brent Crude Oil 1 Year Price History

This Week in Petroleum

Energy Information Administration (EIA) projects prices an increase then a decline in Brent crude oil

“The U.S. EIA expects Brent crude oil to average at $71 per barrel (b) in 2018 and will decline to $68/b for the upcoming year as noted in the June 2018 of its Short-Term Energy Outlook (STEO). The updated forecast price is more than the May STEO by $2. This rise shows global oil market balances that EIA foresees to be closer than prior forecast due to reduced expected growth in production from the Organization of the Petroleum Exporting Countries (OPEC) and the United States. Brent crude oil averages $77/b in May, a climb of $5 from April and the highest monthly average price since November 2014. EIA predicts West Texas Intermediate (WTI) crude oil prices will average almost $7/b less than Brent prices in 2018 and $6/b lower than Brent prices in 2019.”

“OPEC crude oil production will decline of approximately 0.4 million b/d, averaging 32 million b/d in 2018 relative to 2017 as projected by the EIA. There should be a slight increase of total OPEC crude of output to an average of 32.1 million b/d in 2019, regardless of the reduced production in Venezuela and Iran, coupled with the fall of output in other countries.”

“OPEC, Russia, and other non-OPEC countries are expected to meet on June 22, 2018, to assess present oil market conditions associated with their existing crude oil production reductions. Current reductions are scheduled to persists until the end of 2018. Oil ministers from Saudi Arabia and Russia have announced that they will re-evaluate the production reduction agreement given accelerated output declines from Venezuela and uncertainty surrounding Iran’s production levels. In the June STEO, EIA assumes some supply went up from major oil producers in 2019. Depending on the outcome of the June 22 meeting, however, the amount of any supply response is uncertain. EIA currently forecasts global petroleum and other liquids inventories will rise by 210,000 b/d in 2019, which EIA expects will put modest downward pressure on crude oil prices in the second half of 2018 and in 2019.”

For additional information click the link below:

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.