July 2, 2021

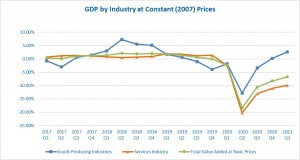

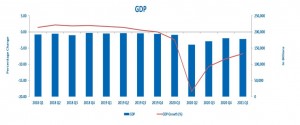

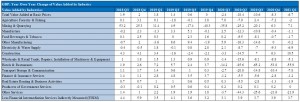

According to the Statistical Institute of Jamaica (STATIN), the total value added in the first quarter of 2021 declined by 6.7 per cent when compared to the similar quarter of 2020. This performance was a reflection of the continued impact of the novel Coronavirus (COVID-19) and the measures adopted to contain its spread. The impact was predominantly felt in the Services Industries which fell by 9.9 per cent. However, the Goods Producing Industries expanded by 2.6 per cent.

Lower levels of activity were recorded in all Services Industries with the exception of the Producers of Government Services which remained relatively unchanged. Declines were recorded for: Hotels & Restaurants (55.9%), Other Services (21.9%), Transport, Storage & Communication (7.8%), Electricity & Water Supply (6.9%), Wholesale & Retail Trade; Repairs; Installation of Machinery & Equipment (5.1%), Real Estate, Renting & Business Activities (1.9%) and Finance & Insurance Services (1.2%).

Decline in the Hotels & Restaurants industry resulted from a fall in hotels & other short-stay accommodation and restaurants, bars & canteens. This industry continued to be negatively impacted by the downturn in the global travel industry. The hotels & other short stay accommodation group was impacted by a 73.3 per cent decrease in foreign national arrivals.

The contraction in the Other Services industry was due to a fall in the recreational, cultural & sporting activities and other services sub-industries. Within the recreational, cultural & sporting activities sub-industry, declines were recorded in tourist related activities, other entertainment activities and betting & gaming activities.

The contraction in the Transport, Storage & Communication industry was influenced by a fall in the transport sub-industry. There was reduced demand for transportation services resulting from the partial closure of schools and the continued work-from home order implemented by the Government to curtail the spread of COVID-19.

The Electricity & Water Supply industry’s decline was due to decreases in both electricity consumption and water consumption of 8.0 per cent and 3.0 per cent respectively. Electricity consumption moved to 725,073 MWh in 2021 from 787,730 MWh in 2020. Water consumption fell to 4,716.7 million gallons in 2021 from 4,864.6 million gallons in 2020. The lower consumption of electricity and water was mainly attributed to reduced consumption by all service categories, notably commercial entities.

The Wholesale & Retail Trade; Repairs; Installation of Machinery & Equipment industry was negatively impacted by lower output levels in the Manufacturing and Agriculture industries. There was also a reduction in consumer demand due to lower levels of employment and the reduction in shopping hours which were implemented to limit the spread of COVID-19.

The Real Estate, Renting & Business Activities industry experienced a fall in the business activities sub-industry while the real estate sub-industry recorded growth during the period. The decline in business activities was influenced primarily by decreases in investigation & security activities, other business services n.e.c., and renting of land transport equipment without operator.

The Finance & Insurance Services industry saw declines in the sub-industries monetary intermediation and other financial intermediation. The decline was tempered by a growth in insurance services. The performance of monetary intermediation was mainly influenced by a decrease in commercial banks. Commercial bank activities were impacted by lower income from fees and commissions largely due to reduced volume of transactions in branch. Lower transaction volumes resulted mainly from measures implemented to limit the spread of COVID-19, including the use of digital platforms. The growth in insurance services was largely due to improved performance in life insurance activities.

Within the Goods Producing Industries higher output levels were recorded in Construction (10.5%) and Mining & Quarrying (7.1%). Growth in the Construction industry for the review period was largely due to building construction which was primarily influenced by an increase in residential construction. While growth in the Mining & Quarrying industry primarily attributed to increased output levels for crude bauxite and alumina. Alumina production grew by 4.5 per cent to 402.7 thousand tonnes in 2021, moving from 385.3 thousand tonnes in 2020. The rise in alumina was due to increased production from the JAMALCO plant. The increase in crude bauxite production was reflected in exports of crude bauxite which increased by 6.3 per cent to 638.6 thousand tonnes in 2021. However, the volume of alumina exported declined for the review period.

However, there were declines in Agriculture, Forestry & Fishing (2.0%) and Manufacturing (1.1%). This was as a result of declines in the sub-industries, Other Agricultural Crops, which includes Animal Farming, Forestry & Fishing and Traditional Export Crops of 2.1 per cent and 1.4 per cent, respectively. The industry’s performance was impacted by dry conditions in some of the major producing areas, coupled with damages sustained to farmlands due to heavy rainfall which occurred in the October to December quarter of 2020.

According to STATIN, “There has been a reduction in the year over year rate of decline, the 6.7 per cent fall being the lowest since the second quarter of 2020. When the performance of the economy in the first quarter of 2021 is compared to that of the fourth quarter of 2020, total value added grew by 0.6 per cent. The economy declined by 11.0 per cent for the fiscal year 2020/2021 compared to fiscal year 2019/2020, reflecting the impact of COVID-19.”

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.