September 01, 2021

Government Operations Results for July 2021

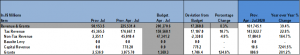

For the period of April to July 2021, the GOJ reported Total Revenues & Grants of $225.53 billion, $17.26 billion more than the Government’s projection. This represented an increase of approximately 39% relative to the $161.75 billion recorded for the corresponding period in 2020. ‘Tax Revenue’, ‘Capital Revenue’ and ‘Grants’ outperformed projections during the review period. ‘Tax Revenue’ amounted to $176.67 billion, $17.11 billion more than budgeted. ‘Capital Revenue’ amounted to $778.20 million during the review period, while ‘Grants’ closed the period at $3.08 billion, $1.71 billion more than the budgeted amount. ‘Non-tax Revenue’ of $45.01 billion was reported, $2.33 billion less than budgeted. Notably, no budgeted amount was booked for ‘Bauxite Levy’ and ‘Capital Revenue’.

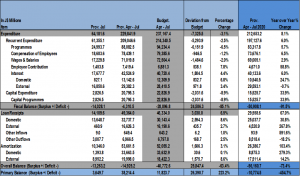

Expenditures

Total Expenditure for the period April to July 2021 amounted to $229.84 billion, $7.33 billion less than the budgeted amount of $237.17 billion. Recurrent expenditure which totalled $209.05 billion, accounted for 90.95% of overall expenditures. Of the recurrent expenditure categories for the review period, the categories above the budgeted amount were ‘Employee Contribution’ and ‘Interest’. ‘Employee Contribution’ amounted to $7.42 billion which was $538.10 million or 7.8% more than budgeted. ‘Interest’ totalled $42.52 billion, 4.4% above the budgeted amount of $40.72 billion. Conversely ‘Compensation of Employees’ totalled $78.44 billion, $946.50 million below the budgeted amount of $79.39 billion. ‘Programmes’ totalled $88.08 billion, 6.5% less than budgeted. Additionally, ‘Wages & Salaries’ totalled $71.02 billion, 2.0% less than the budgeted amount of $72.50 billion.

The ‘Fiscal Deficit’ was $4.31 billion, relative to a ‘Projected Deficit’ of $28.90 billion. Additionally, the ‘Primary Surplus Balance’ for the period amounted to $38.21 billion, relative to the ‘Budgeted Primary Surplus Balance’ of $11.82 billion.

Disclaimer:

Analyst Certification –The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure –The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.