May 4, 2021

Government Operations Results for March 2021

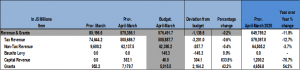

For the period of April 2020 to March 2021, the GOJ reported Total Revenues & Grants of $575.36 billion, $1.14 billion less than the Government’s projection. This represented a decrease of approximately 12% relative to the $649.76 billion recorded for the corresponding period in 2020. ‘Capital Revenue’ and ‘Grants’ outperformed projections during the review period. ‘Capital Revenue’ ended the period at $352.10 million, $304.10 million more than the budgeted $48.00 million. ‘Grants’ amounted to $7.18 billion during the review period and outperformed the budget by $2.16 billion. Conversely, ‘Non-Tax Revenue’ amounted to $62.14 billion, $257.70 million less than budgeted. ‘Tax Revenue’ of $505.69 billion was reported, $3.20 billion less than budgeted. Notably, $145.30 million was budgeted for ‘Bauxite Levy’ however no provision was made for the period.

Expenditures

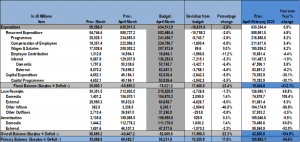

Total Expenditure for the period April 2020 to March 2021 amounted to $635.91 billion, $18.60 billion less than the budgeted amount of $654.51 billion. Recurrent expenditure which totalled $586.73 billion, accounted for 92.27% of overall expenditures. Of the recurrent expenditure categories for the review period, the category above the budgeted amount was ‘Wages & Salaries’ which totalled $208.00 billion, 0.04% above the budgeted amount of $207.91 billion. ‘Compensation of Employees’ amounted to $223.00 billion and was $1.80 billion or 0.8% less than budgeted. Relative to projections, ‘Programmes’ totalled $234.69 billion, 2.8% less than budgeted. Additionally, ‘Employee Contribution’ totalled $15.00 billion, 11.2% less than the budgeted amount of $16.88 billion.

The ‘Fiscal Deficit’ was $60.56 billion, relative to a ‘Projected Deficit’ of $78.02 billion. Additionally, the ‘Primary Surplus Balance’ for the period amounted to $68.48 billion, relative to the budgeted primary surplus of $58.23 billion.

Disclaimer:

Analyst Certification –The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure –The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.