June 12, 2025

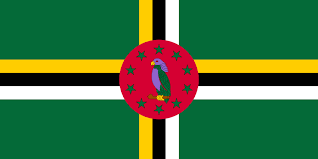

On June 10, 2025, the Executive Board of the International Monetary Fund (IMF) concluded its Article IV consultation with Dominica, endorsing the staff appraisal on a lapse-of-time basis. The Dominican authorities have agreed to publish the accompanying staff report.

Dominica’s economy continues to recover steadily. Real GDP grew by 3.5 percent in 2024, supported by a strong rebound in tourism and strategic public investments aimed at enhancing economic capacity and competitiveness. Inflation moderated to an average of 3.1 percent in 2024, down from a peak of 7 percent in 2023. However, the labor market recovery remains uneven, as formal employment growth has not kept pace with overall economic expansion.

Fiscal and external imbalances have improved but remain significant. The primary fiscal deficit narrowed to 2 percent of GDP in FY2023/24, helped by reduced current spending. Public debt has declined from its pandemic-era peak but remains high at 100 percent of GDP. The current account deficit also narrowed to 32.25 percent of GDP, reflecting increased tourism revenues and a gradual normalization of imports.

The financial sector remains liquid, although vulnerabilities persist. Bank credit continues to contract due to elevated non-performing loans and fragile provisioning. At the same time, credit unions are expanding their lending portfolios rapidly, despite weak capitalization and limited regulatory oversight. Strengthening the financial supervisory framework, particularly for credit unions, is a key priority to ensure financial stability.

Looking ahead, Dominica’s economic outlook is positive. Continued investment in infrastructure and the transition to geothermal energy are expected to reduce fuel imports and improve the external balance. Real GDP growth is projected to average 3.5 percent over the next three years. However, risks remain elevated due to Dominica’s exposure to natural disasters and global economic uncertainties.

The IMF recommends more ambitious fiscal consolidation to reduce debt vulnerabilities and build resilience. Achieving a primary surplus of 3.5 percent of GDP from 2026 onward is considered essential to lowering public debt below 60 percent of GDP by 2035 and to adequately fund the Vulnerability and Resilience Fund. This will require broadening the tax base, optimizing public spending, and improving the targeting of social programs.

Structural reforms are also necessary to support inclusive and sustainable growth. Key priorities include strengthening financial sector oversight, improving labor market outcomes through education and training aligned with economic needs, and enhancing the business environment by streamlining administrative processes and adopting digital tools. Legal reforms in areas such as collateral, foreclosure, and bankruptcy are also important.

Institutional capacity building remains a cornerstone of Dominica’s development strategy. Continued efforts to improve public financial management, statistical systems, and policy execution are vital. Progress on anti-money laundering and counter-financing of terrorism frameworks, along with regional coordination on Citizenship-by-Investment programs, is welcomed. However, further engagement is needed to address international concerns and preserve this important source of development financing.

Source: (Caribbean News Global)

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer(s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view(s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.