July 5, 2024

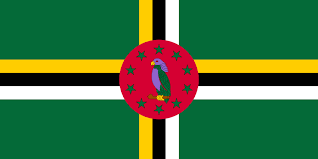

The International Monetary Fund (IMF) concluded its Article IV consultation with Dominica on May 31, 2024. The Dominican economy has rebounded strongly, with real GDP growth of 5.6% in 2022 and an estimated 4.7% in 2023, primarily due to tourism recovery and Citizenship by Investment (CBI) revenues. Inflation dropped significantly from 9.75% in 2022 to 2.25% by the end of 2023.

While fiscal and external imbalances have narrowed, they remain large. The fiscal deficit improved slightly, and public debt has declined but remains over 100% of GDP. The current account deficit widened to 33.7% of GDP in 2023 due to increased imports for infrastructure projects.

The financial system is stable, but non-performing loans remain high. Credit unions are being recapitalized, and credit to the private sector has lagged GDP growth.

The outlook is positive, with continued growth in tourism, geothermal energy production, and infrastructure expansions. For 2024, the IMF projects 4.6% GDP growth and 2.2% inflation. The IMF emphasizes fiscal consolidation, broadening the revenue base, and strengthening tax administration. Recommendations include reintroducing VAT on electricity, rationalizing spending, and adjusting tariffs on public services.

Protecting vulnerable populations and reforming the pension system for sustainability are also key priorities. The IMF advises enhancing financial oversight, particularly for credit unions, and addressing anti-money laundering deficiencies.

The IMF supports Dominica’s modernization and climate resilience efforts, encouraging the use of IMF technical assistance for ongoing reforms. The next consultation is scheduled in 12 months.

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer(s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view(s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.