December 16, 2025

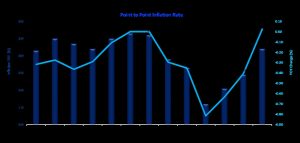

The Statistical Institute of Jamaica (STATIN) reported that as of November 2025, the point-to-point inflation rate was +4.4%; 1.5 percentage points higher than the 2.9% recorded between October 2024 to October 2025. Compared to October 2025, the All-Jamaica Consumer Price Index (CPI) increased by 2.4% in November 2025.

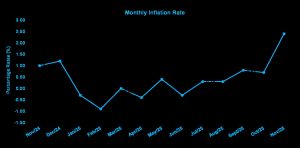

The All Jamaica Consumer Price Index (CPI) for November 2025 was 148.0, reflecting a 2.4% increase over the October 2025 index. This marks the highest monthly movement since September 2013 (up 2.8%) and equals the 2.4% rise recorded in August 2024 following Hurricane Beryl. The November increase is the first to capture the impact of Hurricane Melissa, which made landfall on October 28, 2025.

The main driver of the monthly increase (2.4%) was a 6.0% rise in the index for the ‘Food and Non-Alcoholic Beverages’ division, primarily reflecting higher prices for items in the class ‘Vegetables, tubers, plantains, cooking bananas and pulses’ (up 19.1%) and ‘Fruits and nuts’ (up 8.8%). These movements were influenced by increased costs for agricultural produce following Hurricane Melissa. Additionally, a 0.3% decline in the ‘Housing, Water, Electricity, Gas and Other Fuels’ division partially offset the overall increase, stemming from a 1.3% decrease in the index for ‘Electricity, Gas and Other Fuels’ due to lower electricity rates

The All-Jamaica point-to-point inflation rate for the period November 2024 to November 2025 was 4.4%. The main contributors to this increase were the divisions: ‘Food and Non-Alcoholic Beverages’ (+7.0%), ‘Housing, Water, Electricity, Gas and Other Fuels’ (+3.3%), and ‘Restaurants and Accommodation Services’ (+3.9%).

The rise in the index for the ‘Food and Non-Alcoholic Beverages’ division was largely driven by a 9.3% increase in the ‘Vegetables, tubers, plantains, cooking bananas and pulses’ class, reflecting higher prices for yellow yams, Irish potatoes, tomatoes, and carrots. Additionally, the ‘Meat and other parts of slaughtered land animals’ class rose by 5.8%, mainly due to increased prices for turkey neck, chicken back, whole chicken, and chicken mixed parts.

In the ‘Housing, Water, Electricity, Gas and Other Fuels’ division, the 3.3% increase was primarily attributable to a 7.0% rise in the ‘Imputed Rentals for Housing’ group, reflecting higher rental costs. There was also a 3.8% increase in the ‘Water Supply and Miscellaneous Services’ group, driven by higher water supply and sewage rates.

The 3.9% increase in the ‘Restaurants and Accommodation Services’ division was mainly due to a 4.0% rise in the ‘Food and Beverage Serving Services’ group, stemming from higher prices for meals purchased at fast food restaurants and cookshops.

MAJOR CPI DIVISION MOVEMENTS

The index of the ‘Food and Non-Alcoholic Beverages’ division rose by 6.0% in November 2025, marking the highest monthly increase since November 2007. This movement was primarily driven by a 6.4% rise in the ‘Food’ group, reflecting sharp increases across all classes. Notably, the class ‘Vegetables, tubers, plantains, cooking bananas and pulses’ surged by 19.1%, influenced by higher prices for items such as tomatoes, pumpkins, sweet peppers, hot peppers, and cucumbers following Hurricane Melissa. Additional gains were recorded in ‘Fruits and Nuts’ (+8.8%), due to increased prices for papaya, watermelon, and ackee, and in ‘Ready-made food and other food products’ (+16.4%), mainly from higher escallion prices.

The ‘Non-Alcoholic Beverages’ group advanced by 0.2%, with modest increases in ‘Coffee, Tea & Cocoa’ (+0.2%) and ‘Water, Soft Drinks and Other Non-Alcoholic Beverages’ (+0.1%).

The point-to-point inflation rate for this division was 7.0%.

The index for the ‘Alcoholic Beverages, Tobacco and Narcotics’ division by 0.1% in November 2025. This movement was attributed to a 0.1% rise in the ‘Alcoholic Beverages’ group, mainly due to the index ‘Beer’ class growing by 0.2%.

The point-to-point inflation rate for this division 2.4%.

The index for the ‘Clothing and Footwear’ division posted a 0.3% increase, driven by higher prices in ‘Clothing’ (+0.3%) and ‘Footwear’ (+0.4%).

The point-to-point inflation rate for this division was 3.1%.

The index for the ‘Housing, Water, Electricity, Gas and Other Fuels’ division declined by 0.3%, primarily due to a 1.3% decrease in ‘Electricity, Gas and Other Fuels’, reflecting lower electricity rates. Offsetting this decline was a 1.3% increase in ‘Water Supply and Miscellaneous Services relating to the Dwelling’, driven by higher water supply and sewage charges

The point-to-point inflation rate for this division was 3.3%.

The index for the ‘Furnishings, Household Equipment and Routine Household Maintenance’ division recorded a 0.1% increase. The largest movements were observed in ‘Household Textiles’ (+0.5%) and ‘Tools and Equipment for House and Garden’ (+0.4%).

The point-to-point inflation rate was 3.2%.

The index for the ‘Health’ division rose by 0.2%, driven mainly by a 0.3% increase in ‘Medicines and Health Products’, reflecting higher prices for prescription medications. The ‘Outpatient Care Services’ group also advanced by 0.2%, due to increased dental care fees.

The point-to-point inflation rate was 4.5%.

The index for the ‘Transport’ division remained unchanged relative to the previous month. A 0.1% decline in the class ‘Fuels and lubricants for personal transport equipment’ was recorded, mainly due to lower petrol prices. Following the temporary closure of several gas stations in parishes most affected by Hurricane Melissa, price imputations were applied in line with CPI technical procedures. As part of standard quality assurance, average market prices were also cross-checked against Petrojam’s official rates to ensure accuracy. This decline was offset by a 0.1% increase in the class ‘Other services in respect of personal transport equipment’, driven by higher motor vehicle valuation fees.

The point-to-point inflation rate was 0.3%.

The index for the ‘Recreation, Sport and Culture’ division rose by 0.1%, supported by a 0.2% increase in ‘Newspapers, Books and Stationery’, driven by higher stationery prices.

The point-to-point inflation rate was 3.0%.

The index for the ‘Education’ division rose by 0.5%, driven by increased fees for Caribbean Secondary Education Certificate (CSEC) examinations.

The point-to-point inflation rate was 8.9%.

The index for the ‘Restaurants and Accommodation Services’ division rose by 0.1%, primarily driven by a 0.1% increase in the ‘Food and Beverage Serving Services’ group, reflecting higher prices for meals consumed away from home. This gain was tempered by a 2.7% decline in the ‘Accommodation Services’ group. Following the temporary closure of several hotels after Hurricane Melissa, price imputations were applied in accordance with CPI technical procedures to maintain methodological consistency and statistical integrity

The point-to-point inflation rate was 3.9%.

The index for the ‘Personal Care, Social Protection and Miscellaneous Good and Services’ division advanced by 0.3%, reflecting increased prices for certain services provided by hairdressers and nail technicians.

The point-to-point inflation rate was 3.5%.

Individual divisions saw the following monthly changes:

- Food and Non-Alcoholic Beverages: (+6.0%)

- Alcoholic Beverages, Tobacco and Narcotics: (+0.1%)

- Clothing and Footwear: (+0.3%)

- Housing, Water, Electricity, Gas and Other Fuels: (-0.3%)

- Furnishing, Household Equipment and Routine Household Maintenance: (+0.1%)

- Health: (+0.2%)

- Recreation, Sport, and Culture: (+0.1%)

- Education: (+0.5%)

- Restaurants and Accommodation Services: (+0.1%)

- Personal Care, Social Protection and Miscellaneous Goods and Services: (+0.3%)

Disclaimer:

Analyst Certification – The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure – The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may affect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.