January 16, 2026

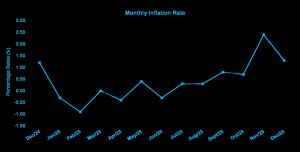

The Statistical Institute of Jamaica (STATIN) reported that as of December 2025, the point‑to‑point inflation rate was +4.5%, representing a 0.1 percentage point increase relative to the 4.4% recorded for the period November 2024 to November 2025. Compared to November 2025, the All‑Jamaica Consumer Price Index (CPI) increased by 1.3% in December 2025.

The All‑Jamaica Consumer Price Index (CPI) for December 2025 was 150.0, reflecting a 1.3% increase over the November 2025 index. This represents a moderation from the 2.4% increase recorded in November 2025 but indicates that inflationary pressures remained elevated. The December movement continued to reflect the impact of Hurricane Melissa, particularly on agricultural prices, alongside higher housing‑related costs. The main driver of the monthly increase (1.3%) was a 2.0% rise in the index for the ‘Food and Non‑Alcoholic Beverages’ division, reflecting higher prices for agricultural produce. Additionally, the ‘Housing, Water, Electricity, Gas and Other Fuels’ division increased by 2.6%, largely influenced by higher electricity rates and rental costs.

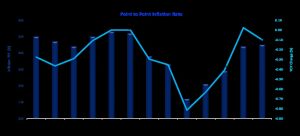

The All‑Jamaica point‑to‑point inflation rate for the period December 2024 to December 2025 was 4.5%. The main contributors to this increase were the divisions ‘Food and Non‑Alcoholic Beverages’ (+7.1%), ‘Housing, Water, Electricity, Gas and Other Fuels’ (+3.5%) and ‘Restaurants and Accommodation Services’ (+3.9%).

Within the ‘Food and Non‑Alcoholic Beverages’ division, all classes registered increases over the point‑to‑point period. The ‘Vegetables, tubers, plantains, cooking bananas and pulses’ class recorded the largest impact (up 8.4%), reflecting higher prices for yam, Irish potato, tomato, carrot, cabbage and pumpkin. Additionally, the ‘Fish and other seafood’ class increased by 8.4%, mainly due to higher prices for salted fish, sardines, mackerel and sliced fish.

In the ‘Housing, Water, Electricity, Gas and Other Fuels’ division, the 3.5% point‑to‑point increase was driven primarily by a 5.1% rise in ‘Imputed Rentals for Housing’, reflecting higher rental costs. There was also a 3.7% increase in ‘Water Supply and Miscellaneous Services relating to the Dwelling’, due to higher water supply and sewage rates.

The 3.9% increase in the ‘Restaurants and Accommodation Services’ division was mainly attributable to a 4.0% rise in the ‘Food and Beverage Serving Services’ group, reflecting higher prices for meals consumed away from home.

MAJOR CPI DIVISION MOVEMENTS

The index of the ‘Food and Non‑Alcoholic Beverages’ division rose by 2.0% in December 2025. The ‘Food’ group increased by 2.1%, driven mainly by a 4.5% rise in ‘Vegetables, tubers, plantains, cooking bananas and pulses’ and a 5.6% increase in ‘Fruits and nuts’, influenced by higher prices for green banana, tomato, pumpkin, hot pepper, ripe banana and watermelon. Additionally, there was a 3.4% increase in the index of the ‘Fish and other seafood’ class largely due to increased prices for salted fish. However, the increase was partially offset by a 1.7% decline in ‘Ready‑made food and other food products’, mainly due to lower escallion prices.

The ‘Non‑Alcoholic Beverages’ group rose by 0.3%, driven by increases in ‘Water, Soft Drinks and Other Non‑Alcoholic Beverages’ (+0.3%), ‘Fruit and Vegetable Juices’ (+0.2%) and ‘Coffee, Tea and Cocoa’ (+0.2%).

Point‑to‑point inflation rate: 7.1%

The index for ‘Alcoholic Beverages, Tobacco and Narcotics’ division increased by 0.2%, reflecting a 0.2% rise in the ‘Alcoholic Beverages’ group.

Point‑to‑point inflation rate: 2.4%

The index for ‘Clothing and Footwear’ rose by 0.3%, driven by increases in ‘Clothing’ (+0.3%) and ‘Footwear’ (+0.1%).

Point‑to‑point inflation rate: 3.2%

The index for ‘Housing, Water, Electricity, Gas and Other Fuels’ increased by 2.6%, primarily due to a 5.4% rise in ‘Electricity, Gas and Other Fuels’, reflecting higher electricity rates. Additionally, ‘Imputed Rentals for Housing’ rose by 1.2%, reflecting higher rental prices.

Point‑to‑point inflation rate: 3.5%

The index ‘Furnishings, Household Equipment and Routine Household Maintenance’ increased by 0.2%, driven mainly by higher prices for household cleaning products such as laundry soap, detergents and all‑purpose cleaners. The ‘Tools and Equipment for House and Garden’ group recorded the highest increase (+0.5%).

Point‑to‑point inflation rate: 3.2%

The index ‘Health’ rose by 0.1%, reflecting higher prices for over‑the‑counter pain relievers within the ‘Medicines and Health Products’ group.

Point‑to‑point inflation rate: 4.4%

The index ‘Recreation, Sport and Culture’ increased by 0.1%, largely due to higher prices for newspapers, books and stationery.

Point‑to‑point inflation rate: 3.0%

The index ‘Restaurants and Accommodation Services’ rose by 0.1%, driven by increased prices for meals consumed away from home.

Point‑to‑point inflation rate: 3.9%

The index ‘Personal Care, Social Protection and Miscellaneous Goods and Services’ advanced by 0.5%, reflecting higher prices for personal care products and grooming services.

Point‑to‑point inflation rate: 3.8%

Individual Divisional Monthly Changes – December 2025

- Food and Non‑Alcoholic Beverages: (+2.0%)

- Alcoholic Beverages, Tobacco and Narcotics: (+0.2%)

- Clothing and Footwear: (+0.3%)

- Housing, Water, Electricity, Gas and Other Fuels: (+2.6%)

- Furnishings, Household Equipment and Routine Household Maintenance: (+0.2%)

- Health: (+0.1%)

- Recreation, Sport and Culture: (+0.1%)

- Restaurants and Accommodation Services: (+0.1%)

- Personal Care, Social Protection and Miscellaneous Goods and Services: (+0.5%)

Disclaimer:

Analyst Certification – The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure – The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may affect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.