Date: May 15, 2019

Jamaican Teas Limited (JAMT) reported a 24% decline in revenues to total $692.45 million (2018: $906.02 million). For the quarter, revenues amounted to $314.22 million compared to $449.87 million in the previous corresponding period. Management stated that, “this was primarily due to increased domestic sales. Export sales improved slightly in the quarter, a welcome reversal of the downturn we saw in the first quarter.”

JAMT further noted that, “supermarket sales show a decline for the quarter from $112 million to $43 million, this is a result of the inclusion of only one month’s operations of JRG. Sales for February and March are included in our associated company, Bay City Foods Ltd (BCF). For the months of Feb and March 2019 BCF’s sales totalled $86 million, a growth in the underlying business for the quarter of 15 per cent.” Additionally, “there were no home sales this quarter due to the completion of Orchid Estates versus $98 million of home sales last year.”

Cost of sales fell 32% to $500.83 million (2018: $733.20 million), in which gross profit went up 11% to close at $191.62 million (2018: $172.83 million). While, gross profit for the quarter closed at $99.84 million (2018: $63.30 million).

Other income increased 44% closing the period at $64.67 million versus $45.04 million in the prior corresponding period. Other income for the quarter closed at $31.76 million compared to $38.15 million documented in the same period last year.

Administrative expenses rose by 3% to $87.59 million for the six months ended March 2018 relative to $84.98 million for the same period of 2018. Sales and marketing costs went up by 47% totaling $28.44 million (2018: $19.40 million). For the quarter administrative expenses and sales & marketing costs closed at $45.72 million (2018: $41.98 million) and $17.87 million (2018: $9.82 million), respectively. JAMT mentioned that, “marketing expenses were significantly higher this quarter due to increased local advertising relating to the launch of our newly strengthened Tetley regular tea and increased in-store promotions for all the company’s products. Income tax expense for the quarter included tax adjustments from the prior quarter required to establish an accurate expense figure for the half year.”

Finance cost for the period under review amounted to $8.67 million (2018: $9.43 million), while for the quarter finance costs closed at $3.44 million versus $4.94 million in the prior corresponding quarter.

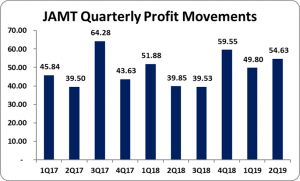

Pretax profits climbed 27%, increasing from $104.05 million in 2018 to $131.91 million in 2019. While, for the quarter, pretax profits closed at $64.89 million (2018: $44.72 million).

Net profit for the period rose by 26% to $116.21 million relative to $90.52 million recorded twelve months earlier. For the quarter, net profit closed at $55.21 million (2018: $40.71 million). Net profits attributable to shareholders for the period under review totaled $103.87 million (2018: $91.59 million). Net profits attributable to shareholders for the quarter closed at $54.63 million (2018: $39.85 million). JAMT stated that, “this partly resulting from the first time inclusion of certain fair value gains on the group’s listed equity investments explained in more detail below but primarily due to the non-recurrence of the losses reported last year on Orchid Estates.”

Consequently, earnings per share totaled $0.15 compared to $0.13 for the period ended March 2019. For the quarter, EPS closed at $0.08 (2018: $0.06). The trailing earnings per share amounted to $0.31. The numbers of shares used in the calculations are 686,033,460 units. JAMT last trade d on May 15, 2019 at $4.09.

JAMT stated that, “We have a strong backlog of export orders as at the time of writing and domestic sales continue to grow. During the month of April, QWI continued to show strong gains in its investment portfolio. The outlook for the third quarter therefore appears to be quite favourable.”

Balance Sheet at a glance:

As at March 2019, the Company total assets amounted to $1.81 billion, an increase of 13% when compared to the $1.60 billion reported as at March 2018. This increase was driven primarily by a 85% growth in ‘Investments’ from $353.11 million in 2018 to $653.83 million for the period under review.

Shareholders’ Equity totalled $1.34 billion as at March 2019 (2018: $1.13 billion), resulting in a book value per share of $1.94 (2018: $1.63).

Disclaimer:

Analyst Certification -This research report is for information purposes only and should not be construed as a recommendation. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may affect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.