Date: November 14, 2018

JMMB Group Limited – (JMMBGL) booked net interest income of $4.35 billion compared to $3.76 billion in 2017, an increase of 16%. Of this, interest income grew by 11% to close at $8.67 billion, from the $7.83 billion booked in 2017, while interest expenses increased by 6% to total 4.32 billion relative to $4.07 billion in the prior year. JMMBGL highlighted that, “there was strong growth in the loan and investment portfolios.” Net interest income for the quarter improved 23% to close at $2.28 billion relative to $1.85 billion a year earlier.

Fees and commission income for the period amounted to $1.19 billion, an improvement of 50% on the $797.10 million recorded for last year’s corresponding period. According to the company, this was, “due to significant growth in managed funds and collective investment schemes across the Group.” Foreign exchange margins from cambio trading recorded an increase of 133% year over year to close the quarter at $1.27 billion (2017: $544.70 million), while net gains from securities trading showed an decline of 17% totalling $2.50 billion (2017: $3.01 billion). Dividend income for the period fell 30% to close at $8.91 million (2017: $12.881 million).

Operating revenue net of interest expense for the six months improved 15% to $9.32 billion versus $8.13 billion in 2017. For the quarter, operating revenue net of interest expense also increase 15% to close at $4.66 billion in contrast to the $4.06 billion recorded in 2017.

JMMBGL recorded an impairment loss on financial assets of $172.05 million, 4% up from the $165.01 million booked for the same period in 2017.

Operating expenses amounted to $6.38 billion, a year over year growth of 12% (2017: $5.67 billion) which led to an operating profit of $2.78 billion, an increase when compared to the $2.29 billion booked the year prior. According to JMMBGL, “This was attributed primarily to costs associated with our integrated Group sales and support framework coupled with the continued build-out of commercial banking services in Jamaica. The Group will continue to focus on extracting operational efficiency from all entities through the launch of its standardization and process improvements project.”

Other income booked for the period declined 49% to $28.63 million relative to a total $56.63 million reported for the corresponding period in 2017. As such, the JMMBGL booked profit before taxation of $2.80 billion for the period, 19% higher than the $2.35 billion recorded in 2017.

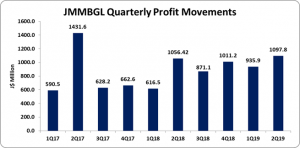

Following taxes of $731.39 million (2017: $680.94 million), JMMBGL booked a 24% increase in net profit to $2.07 billion compared to $1.67 billion reported for the similar period of 2017. Net profit for the quarter totalled $1.12 billion, a 6% increase compared to $1.06 billion recorded in 2017.

Net profit attributable to the shareholders of the company totalled $2.03 million relative to $1.67 million in 2017, a 22% improvement year over year. Net profit attributable to the shareholders of the company for the quarter totalled $1.10 billion, 4% higher than $1.06 billion in 2017.

As a result, earnings per share (EPS) for the six months amounted to $1.25 (2017: $1.03), while for the EPS for the quarter was $0.67 (2017: $0.65).The twelve month trailing EPS amounted to $2.40 where the number of shares used in the calculations amounted to 1,630,552,530 units. Notably, JMMBGL’s stock price closed trading on November 14, 2018 at $33.40

The Company noted, “During the period, in keeping with our strategy execution roadmap for the year, we have made steady progress in driving for improved operational efficiency and embedding our client experience and our financial partnership culture, the latter being a key strategic differentiator.”

Balance Sheet at a glance:

Total assets as at September 30, 2018 amounted to $324.17 billion relative to $275.58 billion in 2017. According to JMMBGL, “This was mainly on account of a larger loan and investment portfolio. The investment portfolio increased by J$25.28 billion or 13% to J$221.30 billion, while loans and advances grew by J$4.90 billion or 9% to J$60.52 billion. The credit quality of the loan portfolio continued to be comparable to international standards.”

Shareholders’ equity totalled $26.68 billion (2017: $28.33 billion). As a result, book value per share stood at $16.36 (2017: $17.37).

Disclaimer: Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.