November 17, 2022

Edufocal Limited (LEARN)

For the nine months ended September 30, 2022:-

Edufocal Limited (LEARN), for the nine months ended September 30, 2022, recorded revenue of $156.61 million, 46% more than the $107.6 million reported in the previous corresponding period. Revenue for the quarter fell 59% to $23.61 million (2021: $57.2 million). LEARN noted, “The Group has continued to exhibit incremental growth in all key divisions, primarily due to new awarded contracts and newly added products.”

Administrative and Operating expenses increased by 42% to $127.23 million relative to the $89.57 million posted for the same period last year. Admin and operating expenses for the quarter amounted to $38.01 million (2021: $42.36 million). According to LEARN this was “driven by higher expenditures in core support areas of the business, specifically staff cost, legal and professional fees, consulting fees and advertising expense.”

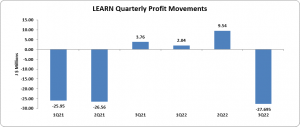

As such, nine months gross profit amounted to $29.38 million, approximately 63% more when compared to the $18.03 million posted a year earlier. Gross loss for the quarter amounted to $14.4 million (Gross profit 2021: $14.84 million).

Other income of $27,015 was reported during the nine-month period (2021: $8,362). Impairment loss on financial asset totalled $21.57 million (2021: $5.35 million).

Finance cost amounted to $23.96 million (2021: $13.39 million). As such, loss before taxation amounted to $16.11 million relative to the loss before taxation of $708,382 reported during the corresponding period in 2021.

No tax charges were incurred during the period (2021: $785,272), as a result net loss amounted to $16.11 million compared to a net loss of $1.49 million in the comparable period last year. Net loss for the quarter was $27.7 million compared to a net profit of $3.76 million in 2021. LEARN attributed this loss to, “higher administrative and finance costs over the comparative period as the group continues to expand its offerings.”

Total comprehensive loss attributable to shareholders closed at $16.11 million versus total comprehensive loss of $1.49 million recorded twelve months earlier.

Loss per share (LPS) amounted to $0.025 for the period relative to loss per share (LPS) of $0.002 in 2021. For the quarter, LPS amounted to $0.043 versus EPS of $0.006. The twelve months trailing loss per share is $0.009. The number of shares used in our calculations is 648,446,094 units. Notably, LEARN’s stock price closed the trading period on November 17, 2022 at $2.76.

Balance Sheet at a glance:-

As at September 30, 2022, total assets totalled $465.72 million, 106% more than the $226.37 million booked as at September 30, 2021. The growth was primarily due to increases in ‘Intangible Asset’ and ‘Receivables and prepayments” which closed at $132.03 million (2021: $66.73 million) and $226.8 million (2021: $126.54 million) respectively. The company noted, “Of note, the 98% jump in intangible assets year over year is largely owed to our acquisition of CST during the financial year. Being a SaaS firm, our intangible assets, including software and intellectual property are more reflective of our productive capacity than property plant and equipment.”

Shareholders’ equity closed at $171.75 million, up from last year’s $66.8 million resulting in book value per share of $0.27 (2021: $0.10).

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may affect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.