February 24, 2023

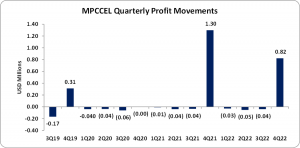

MPC Caribbean Clean Energy Limited (MPCCEL), for the year ended December 31, 2022, recorded total income of US$888,444 relative to US$1.35 million reported for the prior year’s corresponding period.

Total expenses amounted to US$187,651 (2021: US$205,325). The following movements were noted:

Accountancy fees closed the period at US$8,600 (2021: US$8,600), while MPCCEL reported administrative fees of US$61,776 (2021: US$62,550).

Advertising fees for the year amounted to US$34,921 relative to US$14,310 for comparable period in 2021.

Audit fees for the year totalled US$18,375 (2021: US$23,375). The company incurred bank charges for the year of US$3,873 (2021: US$2,816).

Insurance expense for the year ended December 2022 closed at US$20,819 (2021: 17,493).

As result the company booked a net profit of US$700,791 versus US$1.14 million reported at end of 2021 financial year. Comprehensive profit for the year was reported at US$700,791 relative to US$1.14 million reported for the same period in 2021.

Consequently, earnings per share (EPS) for the year ended December 31, 2022 amounted to US$0.032 relative to an EPS of US$0.053 for the same period in 2021. For the quarter, MPCCEL booked EPS of US$0.038 (2021: US$0.060). The number of shares used in this calculation was 21,666,542 units. MPCCEL and MPCCELUS price closed the trading period at a price of J$69.01 and US$0.58 on February 24, 2023, with a corresponding P/E ratio of 13.96 times and 17.93 times, respectively.

MPCCEL highlighted that, “The trend recorded in the last quarter of the year was positive. The still noticeable La Niña phenomenon continues to impact energy production across the region and assets. On a positive note, none of the assets were affected by the weather conditions during the hurricane season, however, the expected restriction in energy production due to rain and cloudy weather has been recorded. After three consecutive years of La Niña, which is a very rare event, experts assume that the effect shall phase out by mid-2023.”

Additionally, “With regard to the expansion (Monte Plata II) of our operating solar PV project in the Dominican Republic, Financial close is expected in Q1 2023 or early Q2. An extension of early works in preparation for substantial civil works has been signed with the date of commercial operation of the expanded capacity constituting Monte Plata II remaining planned for Q1 2024.”

Balance sheet at a Glance:

As at December 31, 2022, Total Assets for the period closed at US$31.64 million versus US$30.90 million. Of this amount ‘Investment – MPC Caribbean Clean Energy Fund LLC’ amounted to US$31.46 million relative to US$30.57 million as at December 31, 2021, cash and cash equivalents amounted to US$164,442 (2021: US$316,174) and ‘Prepayments’ closed at US$12,417 (2021: US$8,602).

Shareholder’s equity totalled US$21.51 million relative to a shareholders’ equity of US$20.81 million booked in 2021. This resulted in a book value per share of US$0.99 relative to of US$0.96 in 2021.

Disclaimer:

Analyst Certification – The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure – The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.