May 13, 2022

Productive Business Solutions Limited (PBS) for the three months ended March 31, 2022 reported a 35% increase in revenues from US$49.34 million for the 2021 period to US$66.36 million in 2022. PBS noted the increase was, “included the sale of over 50,000 personal computers and over 25,000 tablets and interactive classroom content packages to education clients across Central America. PBS also closed a number of large transactions with our banking and retail clients in the Caribbean and Central America for ATM and self-checkout devices.”

Furthermore, “In our security business, PBS closed the implementation of an automated checkpoint solution at a major regional airport. We expect revenue from these transactions to mostly be recorded in subsequent quarters.”

Direct expenses increased 25% to close the period at US$42.11 million when compared to the $33.72 million for the same period of 2021. Notwithstanding, gross profit for the period under review increased by 55% to close at US$24.25 million (2021: US$15.62 million).

Other income rose to US$415,000 relative to US$90,000 in the prior corresponding period.

Selling, general and administrative expenses amounted to US$19.38 million (2021: $13.51 million), a 43% increase year over year.

As such, operating profit went up for the period to total US$5.29 million relative to US$2.20 million in the prior comparable period.

Finance costs increased 114% to total US$3.81 million versus US$1.79 million in 2021. As such, profit before taxation amounted to US$1.48 million relative to a profit of US$419,000 in 2021.

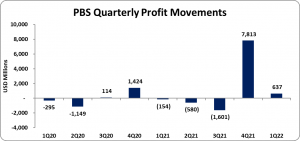

After taxation of US$823,000 (2021: US$565,000), the Company reported net profit of US$654,000 (2021: loss US$146,000). Net profit attributable to shareholders amounted to US$637,000 for the three months ended March 31, 2022 versus a net loss attributable to shareholders of US$154,000 in the comparable period last year.

Comprehensive loss attributable to shareholders for the period was US$156,000 versus loss of US$15,000 in the same period last year.

For the period the company reported a loss per share (EPS) of US$0.0035 (2021: LPS US$0.0008). The twelve month trailing EPS was US$0.0339. The total number of shares employed in our calculations amounted to 186,213,523 units. The stock price closed trading on May 13, 2022 at US$1.18 with a corresponding P/E of 34.80 times.

PBS highlighted, Finally, PBS is pleased to announce that last quarter we renewed our exclusive distribution contract with Xerox across multiple markets.”

Balance Sheet at a glance:

As at March 2022, PBS had total assets totalling US$346.15 million (2021: US$182.14 million), which represents a significant increase of 90%. This movement was mainly attributed to ‘Intangible Assets’ which stood at US$104.05 million (2021: 19.74 million), and ‘Trade and other receivables’ which increased by US$29.89 million to US$85.01 million (2021: US$55.12 million).

Shareholders Equity amounted to US$83.11 million (2021: US$32.75 million) with a book value per share of US$0.446 (2021: US$0.176).

PBS closing statement noted, “PBS’ first quarter performance showcases the capability of our 2,000 information technology professionals across the 19 countries in which we operate. Together, we serve the leading technology brands in the world and the largest governments and companies in our region. We expect PBS’ momentum to continue for the remainder of 2022.”

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.