August 13, 2021

Radio Jamaica Limited (RJR), revenue for the first three months ended June 30, 2021, increased by 34% from $1.06 billion in 2020 to $1.42 billion for the period under review. RJR noted, “the Group’s revenues, driven by an increase in revenues in the Print and Online division ($174 million or 40%), in the Audio/ Visual division ($128 million or 25%) and in the Audio division ($51 million or 40%).” According to management, “the increase were due to increase advertising revenue across all divisions the continued collaboration with the Ministry of Education, and the staging of the ISSA/GraceKennedy Boys’ and Girls’ Championship during the quarter.”

Direct expenses increased to $493.96 million, this compares to the prior year’s figure of $384.52 million, representing an increase of 28%.

As such, gross profit amounted to $926.20 million relative to $675.03 million for the corresponding period in 2020.

Operating expenses increased for the period under review by 16% from $684.60 million in 2020 to $795.19 million in 2021. There was a 6% increase in selling expenses to $242.85 million (2020: $228.20 million), and a 25% increase in administrative expenses to $362.10 million (2020: $290.02 million).

Notably, the increase in administrative expense is driven by “provision for Expected Credit Losses (ECL), IAS 19 provisions, and salary costs. While, other expenses rose due to maintenance of transmitters and other operating equipment,” as stated by Management.

Other income went up for the period to $28.87 million compared to the 2020 figure of $22.10 million, “due to income received from transmitter site rental and the sale of motor vehicles.”

Operating profit closed the period in review at $159.86 million versus operating profit of $12.53 million in 2020.

Finance costs increased 13% year on year to $12.17 million when compared to the corresponding period in 2020 amount of $10.74 million.

Profit before taxation closed the three months at $147.69 million relative to profit before taxation of $1.79 million documented in the previous comparable period.

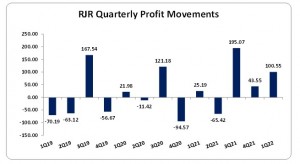

Tax expenses rose to $37.26 million in 2021 from the $284,000 incurred in 2020, which resulted in net profit for the period closing at $110.43 million relative to a profit of $1.50 million for the prior year’s corresponding period in 2020. Net profit attributable to shareholders amounted to $100.55 million versus $25.20 million booked in the same period last year.

The earnings per share (EPS) for the three-month period amounted to $0.042 versus an EPS of $0.010 in 2020. The twelve months trailing earnings per share is $0.10. The number of shares used in this calculation was 2,422,487,654 units. RJR stock last traded on August 12, 2021, at $2.13 with a corresponding P/E of 21.50 times.

RJR noted, ‘the group continues to execute its strategic initiatives by undertaking the necessary investments in technology and by strategic acquisitions building capabilities for operating in an increasingly digital and data driven environment as well as improving the planning for the final phase of Digital Switchover in Television which has been announced for early 2022.”

Balance Sheet Highlights:

The Company, as at June 30, 2021 recorded total assets of $4.65 billion, an increase of 23% when compared to $3.78 billion for the previous corresponding period. This was attributable to an increase in ‘Cash and Bank Balances’ to $606.36 million (2020: $254.73 million), ‘Inventories to $356.25 million (2020: $122.08 million) and ‘Receivables’ to $1.37 billion (2020: $1.15 billion).

Total Stockholders’ equity as at June 30, 2021 closed at $2.63 billion, a increase of 13% from $2.32 billion last year. This resulted in a book value of $1.09 compared to a 2020 value of $0.96.

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may affect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein