RJR reports year end net profit of $145.23 Million for the 2016/17 financial year

Radio Jamaica Limited (RJR) for the year ended March 31, 2017 recorded revenues of $5.23 billion, 127% higher than the$2.31 billion booked for the prior year. The quarter had a 110% increase to $1.20 billion (2016: $574.35 million).” The company noted this was, “due to the addition of GCML revenues and the pre-amalgamated RJR revenues registering a 2% increase.”

Direct Expenses increased by 151% to $2.56 billion relative to $1.02 million for the same period in 2016. As a result, Gross Profit grew by 107% to $2.67 billion relative to last year’s $1.29 billion.

The Company had a 62% increase in total Operating Expenses to $2.63 billion when compared to $1.63 billion posted for the previous year. This was mainly attributed to a 135% increase in other Operating Expenses to $752.92 million versus $319.86 million. Selling Expenses closed the year at $773.48 million, 101% higher than last years $384.57 million. Administration Expenses rose 20% to $1.11 billion (2016: $921.01 million). the company highlighted, “our operations for the financial year were challenged with unplanned extraordinary costs associated with protecting our broadcast copyright and an increase in the cost of repairs to transmitters to ensure consistent quality to viewers and listeners, the turnaround in performance was anticipated following the one off sums in the prior year.” Expenses for quarter declined from $702.67 million in 2016 to $573.70 million.

Other Income amounted to $218.41 million (2016: $102.76 million) representing a 113% increase year over year. Consequently, Operating Profit for the year improved to $259.43 million relative to a loss of $232.94 million.

Finance costs had a 112% increase moving to $39.64 million (2016: $18.66 million) for the year.

As a result, Profit before Tax totaled $219.80 million, this compares to a loss of $251.60 million recorded last year. Tax charges of $75.57 million were recorded for the year, while it amounted to $26.80 million in 2016.

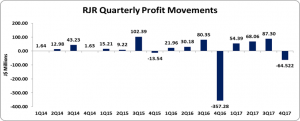

Net Profit for the year was reported at $145.23 million relative to a Net Loss of $224.80 million booked in 2016. According to the company, the increase in performance was due primarily to the net profits of $95M from the now Gleaner Company (Media) Limited (GCML) and an improvement in profitability of the pre-amalgamated RJR Group that recorded higher revenues and lower selling, operating and administrative expenses.” Net Loss for the quarter amounted to $64.52 million compared to a loss of $357.28 million booked last year.

Earnings per share (EPS) for the year amounted to $0.06 versus a loss per share (LPS) of $0.09 booked in the prior year, while for the quarter LPS totaled $0.03 compared to $0.15 in 2016. The number of shares used in our calculations is 2,422,487,654 units.

RJR stated, “with a refocused strategy built around innovation and business expansion to drive improvement in all business units in the changed media and communications environment, the company is confident and committed to the continued realization of transaction synergies and to expand our reach in diverse markets.”

Balance Sheet Highlights:

As at March 31, 2017, the Company reported total assets of $3.85 billion, 5% less when compared to $4.04 billion in the prior year.

Shareholders’ Equity as at March 31, 2017 was $2.60 billion compared to $2.42 billion for the prior year. This resulted in a book value per share of $1.07 compared to $1.00 a year ago.

Disclaimer:

Analyst Certification -This research report is for information purposes only and should not be construed as a recommendation. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.