August 18, 2025

Sagicor Select Funds Limited Manufacturing & Distribution(SELECTMD)

Unaudited financials for the six months ended June 30, 2025:

Sagicor Select Funds Limited Manufacturing & Distribution (SELECTMD) for the six months ended June 30, 2025, reported a 2% decrease in Interest Income totaling $7.24 million compared to $7.38 million in the corresponding period last year. Interest Income for the second quarter had an 18% decrease to close at $3.04 million compared to $3.70 million for the comparable quarter of 2024.

Dividend Income amounted to $68.62 million (2024: $ 44.76 million), representing a 53% year-over-year increase. Consequently, net investment income decreased to a loss of $64.67 million compared to a gain of $227.31 million for the six months ending June 30, 2024. The company reported a net investment loss of $90.67 million for the second quarter, compared to a net income of $173.86 million for the same quarter of 2024.

Financial assets at fair value through P&L decreased to close at $140.53 million (2024: profit of $175.18 million).

Administration expenses for the six months ended June 30, 2025, amounted to $16.40 million, a 1% decrease relative to $16.53 million reported in 2024. Administration expenses for the second quarter amounted to 9.09 million (2024: $10.00 million).

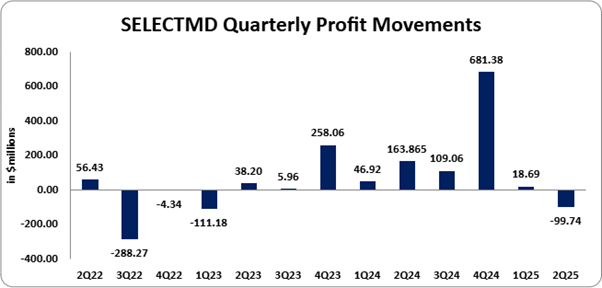

Total expenses for the six months ended June 30, 2025, had a 1% decrease to reach $16.40 million (2024: $16.53 million). Net loss for the six months amounted to $81.20 million, a decrease from a profit of $210.78 million reported in 2024. For the second quarter, Net loss was $99.75 million (2024: profit of $163.87 million). “The Select M&D Fund’s six-month decline was primarily due to significant unrealized losses on financial assets at fair value, may have overshadowed dividend growth and stable expenses. However, this performance, while mirroring the current market conditions, also underscores the fund’s resilience. The structure of its holdings, which enhances the dividend yield on assets”

Consequently, Loss Per Share for the six months amounted to $0.02 (2024: EPS: $0.06), while Loss Per Share for the quarter totaled $0.03 (2024: EPS: $0.04). The twelve-month trailing EPS was $0.12, and the number of shares used in these calculations was 3,816,612,000.

Notably, SELECTMD’s stock price closed the trading period on August 17, 2025, at a price of $0.83 with a corresponding P/E ratio of 6.94x.

Balance Sheet Highlights

The company’s assets totaled $4.77 billion (2024: $4.31 billion). The increase in the company’s total asset base is driven by a 74% YoY increase in “Cash and Cash Equivalents” ending the quarter at $338.30 million (2024: $194.10 million), a 8% YoY increase in “Financial Assets at FVTPL” ending the quarter at $4.43 billion (2024: $4.11 billion) and a 98% YoY increase in “Receivables” ending the quarter at $4.86 million (2024: $2.45 million).

Shareholders’ equity was $4.75 billion (2024: $4.29 billion), representing a book value per share of $1.24 (2024: $1.12).

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may affect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.