January 16, 2023

Sygnus Real Estate Finance Ltd. for the first quarter ended November 30, 2022, reported a 65% increase in interest income to $33.84 million (2021: $20.54 million).

Interest expense also increase 65% to $62 million (2021: $37.56 million). SRF noted, “the Group continued to unlock value from its major real estate investment assets by achieving another set of key milestones, namely: advancing the J$3.70 billion Belmont Road 9-storey commercial tower to 74.0% completion and remaining on track for completion in mid 2023, with four of the five floors effectively leased with 10-year renewable agreements; advanced the construction of the built-to-suit industrial warehouse facility on Spanish Town Road to 87.0% completion; made submissions to various agencies to secure approvals for the beachfront hospitality investment property in Mammee Bay, St. Ann; continued to engage in partnership discussions and financing options with international investors and financiers with regards to Sepheus Holdings Limited, the SRF subsidiary which holds the Mammee Bay asset.”

Fair value loss from financial instruments at fair value closed at $23.39 million (2021: $10.87 million). Foreign exchange loss increased 184% to $66.74 million (2021: loss of $23.46 million).

Other income amounted to $8.25 million (2021: nil).

Operating expenses increased 25% to $103.70 million (2021: $82.97 million). Of this:

- Management fees increased 42% to $68.63 million (2021: $48.32 million)

- Corporate service fees increased 25% to $11.55 million (2021: $9.24 million)

- No performance fees were recorded (2021: $12.49 million)

- Other expenses increased 82% to $23.52 million (2021: $12.93 million)

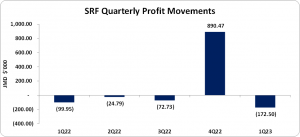

Consequently, operating loss grew 77% to $172.64 million (2021: $97.79 million).

The Company recorded share of profit of joint venture of $146,000 (2021: loss of $2.16 million). Consequently, net loss for the period increased 73% to $172.50 million ($99.95 million).

Following translation adjustment on consolidation of overseas subsidiary of $62,000 (2021: $44,000), total comprehensive loss totalled $172.56 million (2021: $99.99 million).

Loss per share (LPS) for the quarter amounted to $0.92 (2021: LPS of $0.53). The trailing twelve months earnings per share amounted to $3.31. The number of shares used in our calculations is 187,392,532. SRFJMD and SRFUSD stock price closed the trading period at a price of $9.50 and $0.12 respectively on January 16, 2023, with a corresponding P/E ratio of 2.87 times.

Balance sheet at a glance:

As at November 30, 2022, total assets increased 46% to $14.54 billion (2021: $9.97 billion). This was mainly attributed to ‘Investment Property’ which increased 37% to $9.94 billion (2021: $7.25 billion).

Shareholders’ equity increased 9% to $7.42 billion (2021: $6.80 billion), resulting in a book value per share of $39.58 (2021: $36.27).

Disclaimer:

Analyst Certification – The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure – The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.