November 11, 2025

Supreme Ventures Limited (SVL)

Unaudited financials for the nine months ended September 30, 2025

Supreme Ventures Limited (SVL), for the nine months ended September 30, 2025, reported a 7% YoY increase in Total Gaming Income to $41.78 billion, up from $39.11 billion in the corresponding period of 2024. The Company’s continued emphasis on digital transformation and product diversification drove solid revenue growth across both its non-fixed-odds and fixed-odds wagering segments.

Revenue Performance

Revenue from non-fixed odds wagering games, horse racing, and pin codes rose 5% YoY to $25.58 billion (2024: $24.28 billion), supported by consistent demand across core lottery games and expanding participation in horse racing.

Income from fixed odds wagering games, net of prizes, increased 9% YoY to $16.20 billion (2024: $14.83 billion), reflecting higher sports betting activity and improved margin management through technology-driven risk control. As a result, Total Gaming Income climbed 7% YoY year-over-year to $41.78 billion (2024: $39.11 billion).

Expense and Profitability Analysis

Direct Expenses increased 7% YoY to $32.26 billion (2024: $30.21 billion), mainly attributable to higher gaming taxes, commission payouts, and technology platform costs associated with increased activity.

Gross Profit for the period grew 7% YoY to $9.52 billion (2024: $8.90 billion), highlighting the company’s ability to maintain cost discipline despite higher operational inputs.

Selling, general, and administrative expenses (SG&A) increased 4% YoY to $6.64 billion (2024: $6.42 billion), driven primarily by marketing investments and strategic digital initiatives. For the third quarter alone, SG&A decreased 9% YoY year-over-year to $2.19 billion, demonstrating enhanced efficiency and cost containment efforts.

Other Income declined significantly to a loss of $39.37 million (2024: gain of $359.88 million), reflecting the non-recurrence of prior-year one-off income streams and accounting adjustments. Consequently, Operating Profit remained relatively flat at $3.04 billion (2024: $3.05 billion).

Finance Costs increased 8% YoY to $652.79 million (2024: $604.58 million) due to higher interest rates and the expansion of working capital facilities. Profit Before Taxation recorded a slight 2% YoY decline to $2.39 billion (2024: $2.45 billion), reflecting increased finance costs and reduced other Income.

However, Taxation decreased 26% YoY to $554.91 million (2024: $746.69 million), attributable to effective tax planning and timing differences on deductible expenses. As a result, Profit Attributable to Shareholders rose 9% YoY to $1.85 billion (2024: $1.70 billion).

Earnings Per Share (EPS) for the nine months amounted to $0.70 (2024: $0.64), while the Trailing Twelve-Month (TTM) EPS stood at $0.74, signalling a steady upward earnings trajectory. The company’s P/E ratio was 23.80x, based on the last traded stock price of $17.59 as of November 4, 2025.

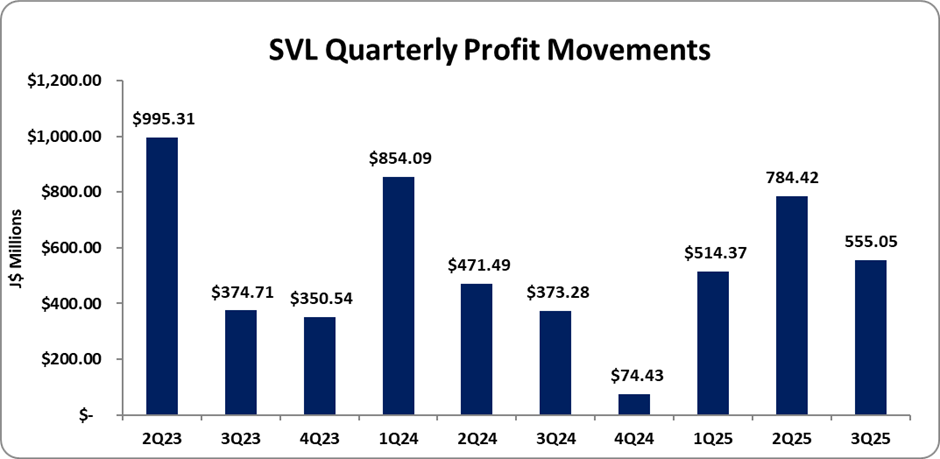

Quarterly Highlights

For the quarter ended September 30, 2025, SVL delivered a strong performance with Operating Profit increasing 33% YoY to $978.23 million (2024: $736.70 million) and Profit Before Taxation rising 40% YoY to $754.95 million (2024: $539.56 million). Profit Attributable to Shareholders surged 55% YoY to $555.05 million (2024: $373.28 million), underscoring the company’s robust operational momentum. Quarterly EPS improved to $0.22 (2024: $0.14).

Balance Sheet Highlights

SVL’s Total Assets increased marginally by 1% YoY to $21.96 billion (2024: $21.82 billion), driven by a 13% YoY in Investment Properties ending the quarter at $1.06 billion (2024: $942.00 million), a 123% YoY increase in Loans and advances, net of provision for credit losses ending the quarter at $529.88 million (2024: $237.79 million), a 8% YoY increase in Trade and other receivables ending the quarter at $4.56 billion (2024: $4.24 billion) and a 19% YoY increase in Current portion of loans and advances ending the quarter at $1.73 billion (2024: $1.45 billion) reflecting continued reinvestment in core operational infrastructure and service offerings.

Shareholders’ Equity expanded 15% YoY to $5.19 billion (2024: $4.51 billion), driving an improvement in Book Value per Share to $1.97 (2024: $1.71). The company’s solid capital base provides a strong foundation for future growth, dividend sustainability, and strategic regional expansion.

Disclaimer:

Analyst Certification – The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure – The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.